Question: Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest

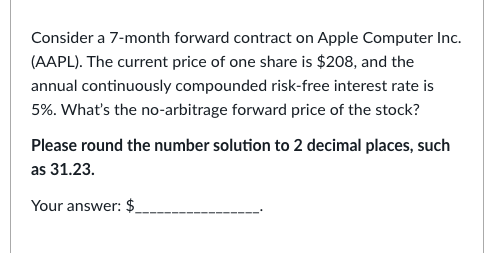

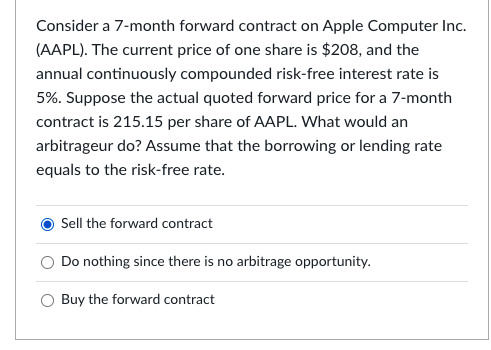

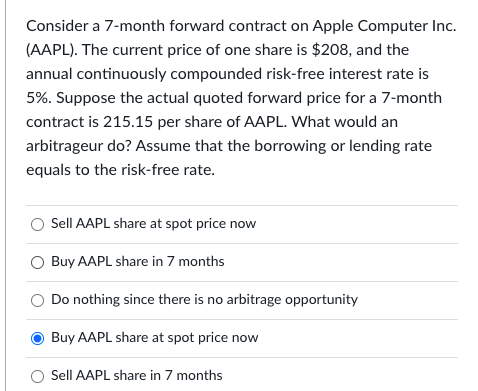

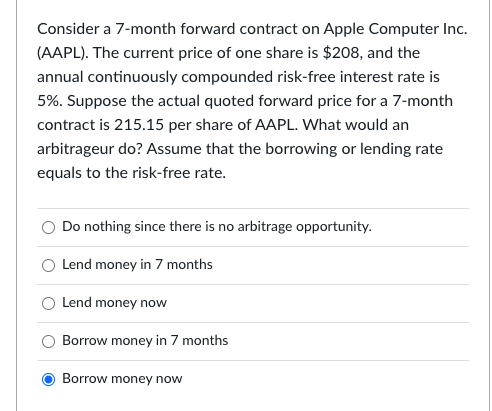

Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest rate is 5%. What's the no-arbitrage forward price of the stock? Please round the number solution to 2 decimal places, such as 31.23. Your answer: $ Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest rate is 5%. Suppose the actual quoted forward price for a 7-month contract is 215.15 per share of AAPL. What would an arbitrageur do? Assume that the borrowing or lending rate equals to the risk-free rate. Sell the forward contract Do nothing since there is no arbitrage opportunity. Buy the forward contract Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest rate is 5%. Suppose the actual quoted forward price for a 7-month contract is 215.15 per share of AAPL. What would an arbitrageur do? Assume that the borrowing or lending rate equals to the risk-free rate. Sell AAPL share at spot price now Buy AAPL share in 7 months Do nothing since there is no arbitrage opportunity Buy AAPL share at spot price now Sell AAPL share in 7 months Consider a 7-month forward contract on Apple Computer Inc. (AAPL). The current price of one share is $208, and the annual continuously compounded risk-free interest rate is 5%. Suppose the actual quoted forward price for a 7-month contract is 215.15 per share of AAPL. What would an arbitrageur do? Assume that the borrowing or lending rate equals to the risk-free rate. Do nothing since there is no arbitrage opportunity. Lend money in 7 months Lend money now Borrow money in 7 months Borrow money now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts