Question: Consider a bear money spread using the March 80/75 puts. Instructions: For the next 5 questions, suppose an investor expects the stock price to remain

Consider a bear money spread using the March 80/75 puts.

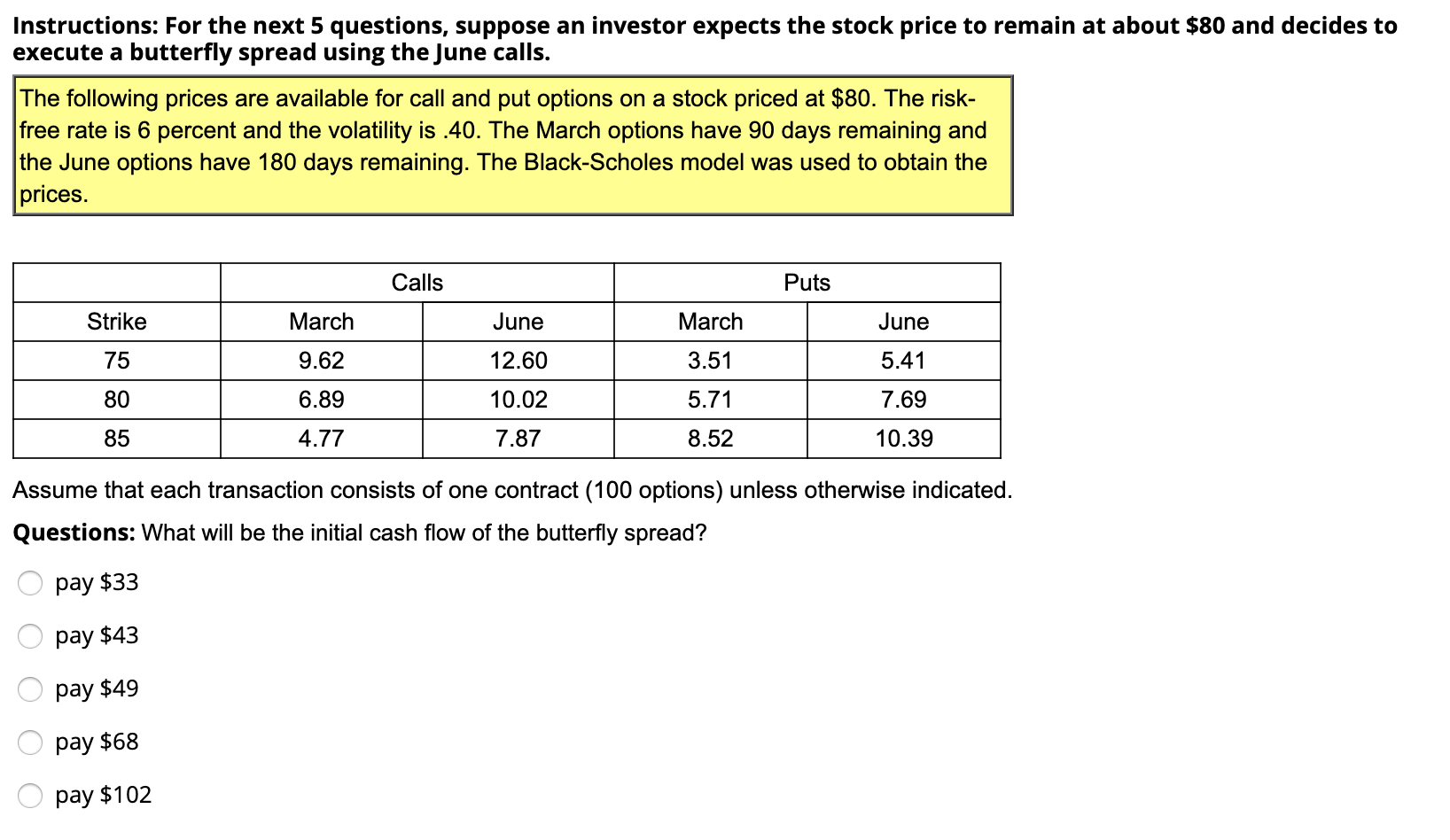

Instructions: For the next 5 questions, suppose an investor expects the stock price to remain at about $80 and decides to execute a butterfly spread using the June calls. The following prices are available for call and put options on a stock priced at $80. The risk- free rate is 6 percent and the volatility is .40. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices. Calls Puts Strike March June March June 75 9.62 12.60 3.51 5.41 80 6.89 10.02 5.71 7.69 85 4.77 7.87 8.52 10.39 Assume that each transaction consists of one contract (100 options) unless otherwise indicated. Questions: What will be the initial cash flow of the butterfly spread? o pay $33 O pay $43 o pay $49 o pay $68 O pay $102

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts