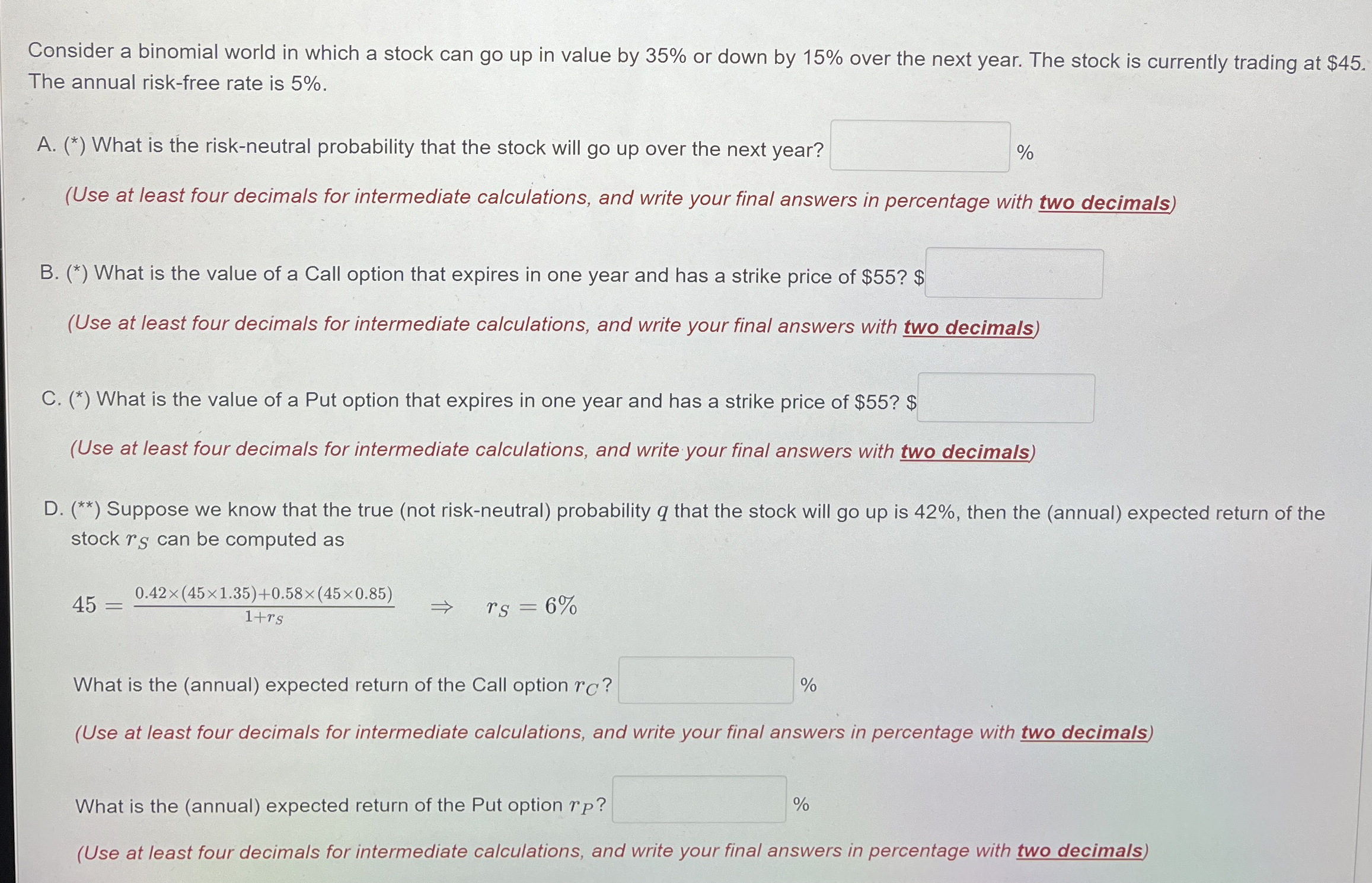

Question: Consider a binomial world in which a stock can go up in value by 3 5 % or down by 1 5 % over the

Consider a binomial world in which a stock can go up in value by or down by over the next year. The stock is currently trading at $

The annual riskfree rate is

A What is the riskneutral probability that the stock will go up over the next year?

Use at least four decimals for intermediate calculations, and write your final answers in percentage with two decimals

B What is the value of a Call option that expires in one year and has a strike price of $ $

Use at least four decimals for intermediate calculations, and write your final answers with two decimals

C What is the value of a Put option that expires in one year and has a strike price of $ $

Use at least four decimals for intermediate calculations, and write your final answers with two decimals

D Suppose we know that the true not riskneutral probability that the stock will go up is then the annual expected return of the

stock can be computed as

What is the annual expected return of the Call option

Use at least four decimals for intermediate calculations, and write your final answers in percentage with two decimals

What is the annual expected return of the Put option

Use at least four decimals for intermediate calculations, and write your final answers in percentage with two decimals

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock