Question: Consider a Black-Scholes model with r = 6%, sigma = 0.25, S(0) = 50 and sigma = 0. Suppose you sold ten (10) 90-day Puts

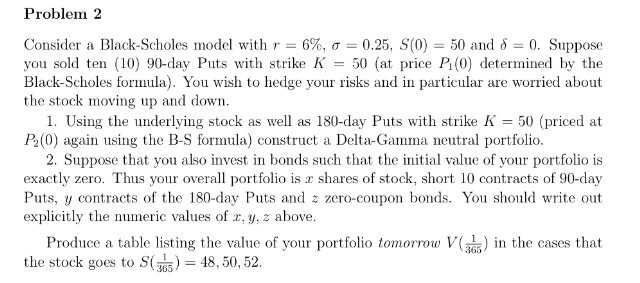

Consider a Black-Scholes model with r = 6%, sigma = 0.25, S(0) = 50 and sigma = 0. Suppose you sold ten (10) 90-day Puts with strike K = 50 (at price A(0) determined by the Black-Scholes formula). You wish to hedge your risks and in particular arc worried about the stock moving up and down. 1. Using the underlying stock as well as 180-day Puts with strike K = 50 (priced at P_2 (0) again using the B-S formula) construct a Delta-Gamma neutral portfolio. 2. Suppose that you also invest in bonds such that the initial value of your portfolio is exactly zero. Thus your overall portfolio is x shares of stock, short 10 contracts of 90-day Puts, y contracts of the 180-day Puts and z zero-coupon bonds. You should write out explicitly the numeric values of x, y, z above. Produce a table listing the value of your portfolio tomorrow V(1/365) in the cases that the stock goes to s(1/365) = 48,50,52. Consider a Black-Scholes model with r = 6%, sigma = 0.25, S(0) = 50 and sigma = 0. Suppose you sold ten (10) 90-day Puts with strike K = 50 (at price A(0) determined by the Black-Scholes formula). You wish to hedge your risks and in particular arc worried about the stock moving up and down. 1. Using the underlying stock as well as 180-day Puts with strike K = 50 (priced at P_2 (0) again using the B-S formula) construct a Delta-Gamma neutral portfolio. 2. Suppose that you also invest in bonds such that the initial value of your portfolio is exactly zero. Thus your overall portfolio is x shares of stock, short 10 contracts of 90-day Puts, y contracts of the 180-day Puts and z zero-coupon bonds. You should write out explicitly the numeric values of x, y, z above. Produce a table listing the value of your portfolio tomorrow V(1/365) in the cases that the stock goes to s(1/365) = 48,50,52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts