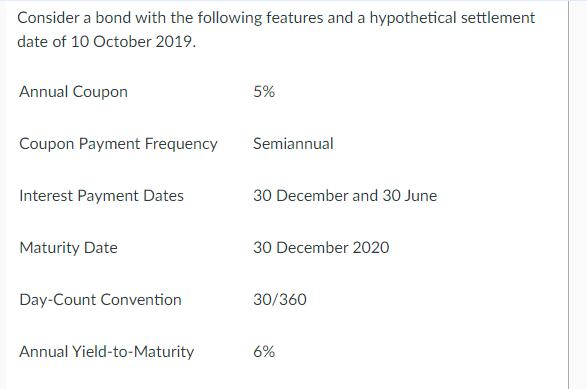

Question: Consider a bond with the following features and a hypothetical settlement date of 10 October 2019. Annual Coupon 5% Coupon Payment Frequency Semiannual Interest

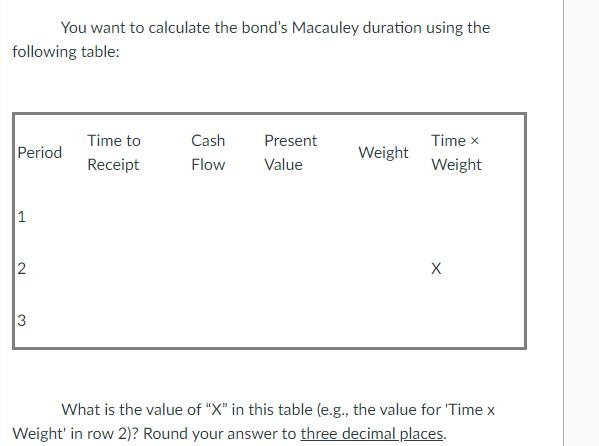

Consider a bond with the following features and a hypothetical settlement date of 10 October 2019. Annual Coupon 5% Coupon Payment Frequency Semiannual Interest Payment Dates 30 December and 30 June Maturity Date 30 December 2020 Day-Count Convention 30/360 Annual Yield-to-Maturity 6% You want to calculate the bond's Macauley duration using the following table: Time to Cash Present Period Weight Receipt Flow Value Time x Weight 1 2 3 What is the value of "X" in this table (e.g., the value for 'Time x Weight' in row 2)? Round your answer to three decimal places.

Step by Step Solution

There are 3 Steps involved in it

Answer We can calculate the value of X Time x Weight in row 2 for the Macaulay duration table Heres how 1 Missing Information We need the following in... View full answer

Get step-by-step solutions from verified subject matter experts