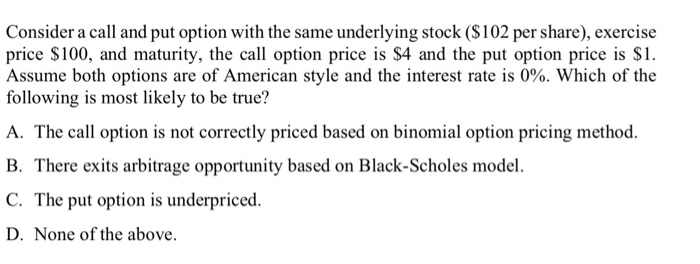

Question: Consider a call and put option with the same underlying stock ($102 per share), exercise price $100, and maturity, the call option price is $4

Consider a call and put option with the same underlying stock ($102 per share), exercise price $100, and maturity, the call option price is $4 and the put option price is $1. Assume both options are of American style and the interest rate is 0%. Which of the following is most likely to be true? A. The call option is not correctly priced based on binomial option pricing method. B. There exits arbitrage opportunity based on Black-Scholes model. C. The put option is underpriced. D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts