Question: Consider a doubly stochastic Poisson process X with cumulated intensity A(t) = X(s)ds. The time of default 7(w) of a bond is given by the

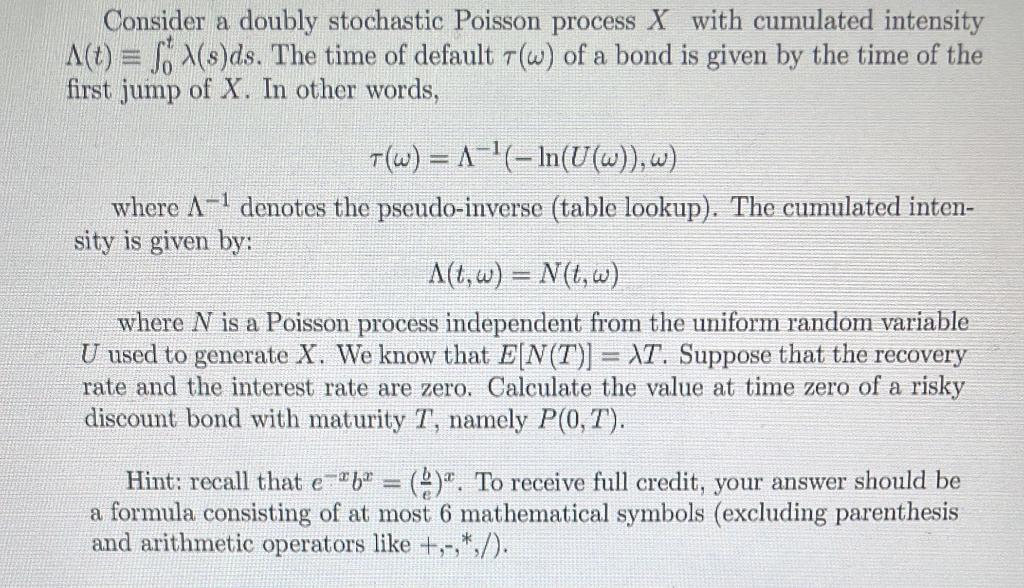

Consider a doubly stochastic Poisson process X with cumulated intensity A(t) = X(s)ds. The time of default 7(w) of a bond is given by the time of the first jump of X. In other words, t(w) = A-'(- In(U(w)),w) where A-' denotes the pseudo-inverse (table lookup). The cumulated inten- sity is given by: A(t,w) = N(I,w) where N is a Poisson process independent from the uniform random variable U used to generate X. We know that E[N(T)] = \T. Suppose that the recovery rate and the interest rate are zero. Calculate the value at time zero of a risky discount bond with maturity T, namely P(0,T). Hint: recall that e-*b* = (9)". To receive full credit, your answer should be a formula consisting of at most 6 mathematical symbols (excluding parenthesis and arithmetic operators like +,-,*,/). Consider a doubly stochastic Poisson process X with cumulated intensity A(t) = X(s)ds. The time of default 7(w) of a bond is given by the time of the first jump of X. In other words, t(w) = A-'(- In(U(w)),w) where A-' denotes the pseudo-inverse (table lookup). The cumulated inten- sity is given by: A(t,w) = N(I,w) where N is a Poisson process independent from the uniform random variable U used to generate X. We know that E[N(T)] = \T. Suppose that the recovery rate and the interest rate are zero. Calculate the value at time zero of a risky discount bond with maturity T, namely P(0,T). Hint: recall that e-*b* = (9)". To receive full credit, your answer should be a formula consisting of at most 6 mathematical symbols (excluding parenthesis and arithmetic operators like +,-,*,/)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts