Question: Consider a firm with a production function as: y=KL-a Where K is capital, L is labor, y is output and 0 < a <

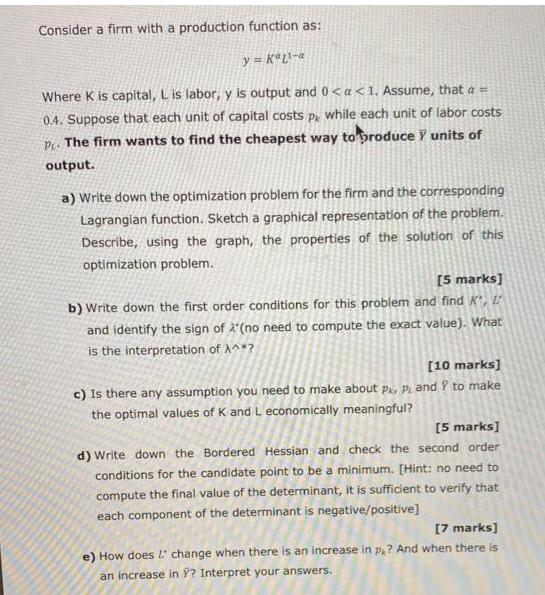

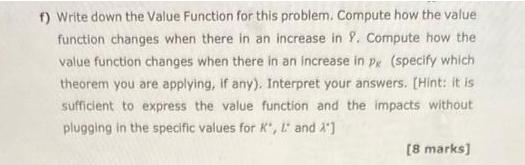

Consider a firm with a production function as: y=KL-a Where K is capital, L is labor, y is output and 0 < a < 1. Assume, that a = 0.4. Suppose that each unit of capital costs p while each unit of labor costs PL. The firm wants to find the cheapest way to produce y units of output. a) Write down the optimization problem for the firm and the corresponding Lagrangian function. Sketch a graphical representation of the problem. Describe, using the graph, the properties of the solution of this optimization problem. [5 marks] b) Write down the first order conditions for this problem and find K", L' and identify the sign of '(no need to compute the exact value). What is the interpretation of A^*? [10 marks] c) Is there any assumption you need to make about P. PL and to make the optimal values of K and L economically meaningful? [5 marks] d) Write down the Bordered Hessian and check the second order conditions for the candidate point to be a minimum. [Hint: no need to compute the final value of the determinant, it is sufficient to verify that each component of the determinant is negative/positive] [7 marks] e) How does l change when there is an increase in p? And when there is an increase in Y? Interpret your answers. f) Write down the Value Function for this problem. Compute how the value function changes when there in an increase in 9. Compute how the value function changes when there in an increase in P (specify which theorem you are applying, if any). Interpret your answers. [Hint: it is sufficient to express the value function and the impacts without plugging in the specific values for K', L' and A"] [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step 1 Roughly speaking this is the graph where the minimal value functio... View full answer

Get step-by-step solutions from verified subject matter experts