Question: Consider a forward contract on some asset A, with a delivery date of T years from now. Let to be the current date when

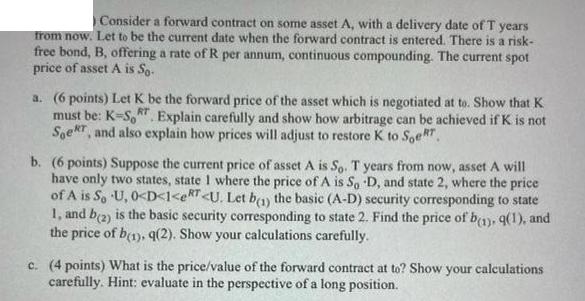

Consider a forward contract on some asset A, with a delivery date of T years from now. Let to be the current date when the forward contract is entered. There is a risk- free bond, B, offering a rate of R per annum, continuous compounding. The current spot price of asset A is So. a. (6 points) Let K be the forward price of the asset which is negotiated at to. Show that K must be: K-ST. Explain carefully and show how arbitrage can be achieved if K is not Soer, and also explain how prices will adjust to restore K to Soe b. (6 points) Suppose the current price of asset A is So. T years from now, asset A will have only two states, state 1 where the price of A is So D, and state 2, where the price of A is So U, 0

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

a To show that K must be K S0 lets assume that K is not equal to S0 If K S0 there is an arbitrage opportunity for a trader to make riskfree profits Th... View full answer

Get step-by-step solutions from verified subject matter experts