Question: Consider a given bond that has five years maturity, Br.1000 face value and a 10 percent coupon rate. Suppose a broker's commission of Br.50

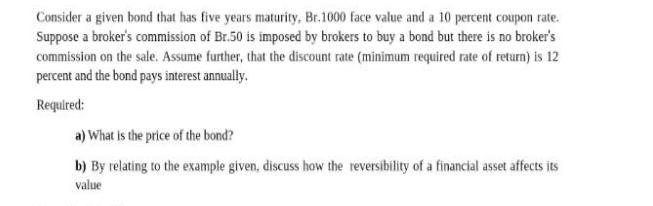

Consider a given bond that has five years maturity, Br.1000 face value and a 10 percent coupon rate. Suppose a broker's commission of Br.50 is imposed by brokers to buy a bond but there is no broker's commission on the sale. Assume further, that the discount rate (minimum required rate of return) is 12 percent and the bond pays interest annually. Required: a) What is the price of the bond? b) By relating to the example given, discuss how the reversibility of a financial asset affects its value

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

a First lets calculate the annual coupon payment The bond has a face value of Br1000 and a coupon rate of 10 percent Therefore the annual coupon payme... View full answer

Get step-by-step solutions from verified subject matter experts