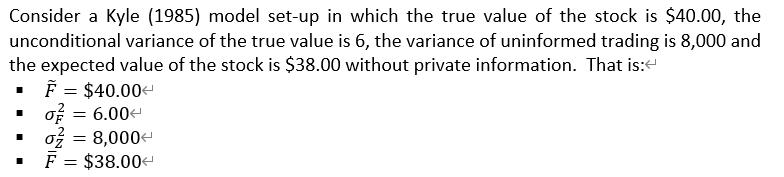

Question: Consider a Kyle (1985) model set-up in which the true value of the stock is $40.00, the unconditional variance of the true value is

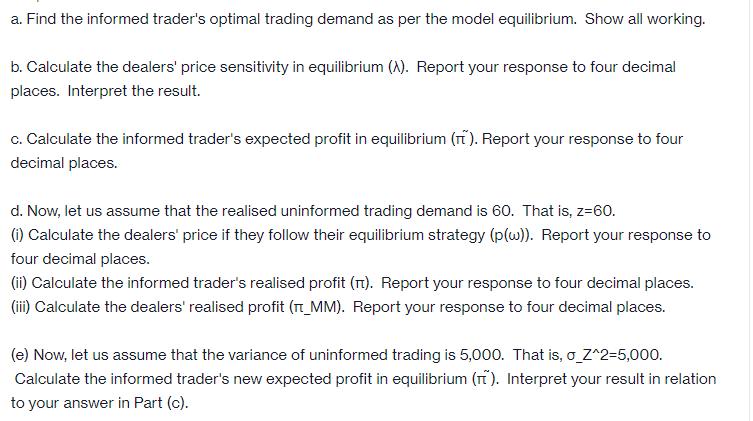

Consider a Kyle (1985) model set-up in which the true value of the stock is $40.00, the unconditional variance of the true value is 6, the variance of uninformed trading is 8,000 and the expected value of the stock is $38.00 without private information. That is: F = $40.00 07 = 6.00 o = 8,000 F = $38.00 < a. Find the informed trader's optimal trading demand as per the model equilibrium. Show all working. b. Calculate the dealers' price sensitivity in equilibrium (A). Report your response to four decimal places. Interpret the result. c. Calculate the informed trader's expected profit in equilibrium (r). Report your response to four decimal places. d. Now, let us assume that the realised uninformed trading demand is 60. That is, z=60. (i) Calculate the dealers' price if they follow their equilibrium strategy (p(w)). Report your response to four decimal places. (ii) Calculate the informed trader's realised profit (r). Report your response to four decimal places. (iii) Calculate the dealers' realised profit (_MM). Report your response to four decimal places. (e) Now, let us assume that the variance of uninformed trading is 5,000. That is, _Z^2=5,000. Calculate the informed trader's new expected profit in equilibrium (r). Interpret your result in relation to your answer in Part (c).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts