Question: Consider a one-period binomial model with initial stock price So, up factor u, down factor d, initial bond price Ag, bond return r, up probability

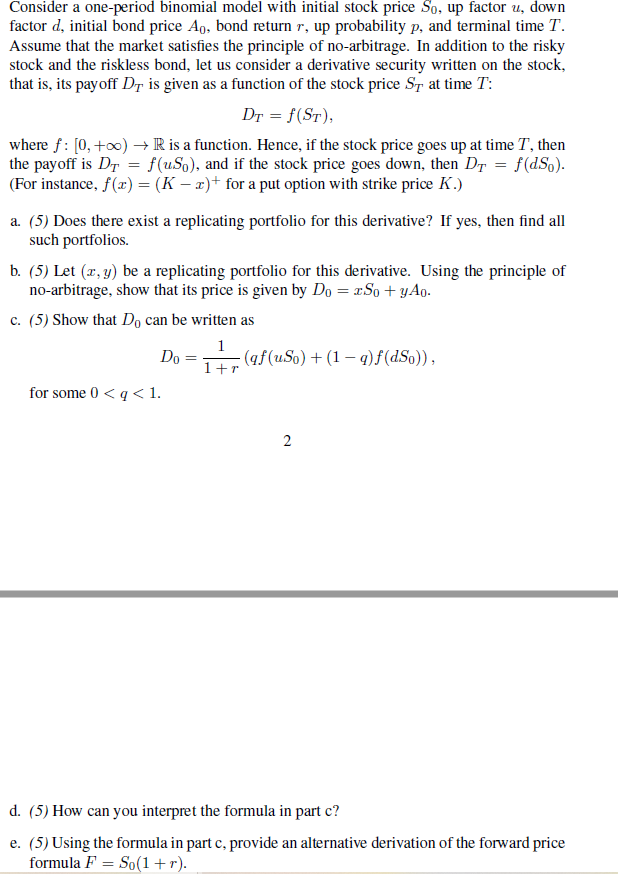

Consider a one-period binomial model with initial stock price So, up factor u, down factor d, initial bond price Ag, bond return r, up probability p, and terminal time T. Assume that the market satisfies the principle of no-arbitrage. In addition to the risky stock and the riskless bond, let us consider a derivative security written on the stock, that is, its payoff Dy is given as a function of the stock price Sy at time T: Dr = f(ST), where f: [0, +00) + R is a function. Hence, if the stock price goes up at time T', then the payoff is DT f(US), and if the stock price goes down, then Dt = f(ds.). (For instance, f (t) = (K )+ for a put option with strike price K.) a. (5) Does there exist a replicating portfolio for this derivative? If yes, then find all such portfolios. b. (5) Let (2, y) be a replicating portfolio for this derivative. Using the principle of no-arbitrage, show that its price is given by Do = 3:So + yAn. c. (5) Show that D. can be written as 1 DO (qf (So) + (1 - 9)f(dSo), 1+r for some 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts