Question: Q. 2 (Put options, 55 pts). Consider a three-period binomial model with up factor u = 1.3, down factor d = 0.9, and initial stock

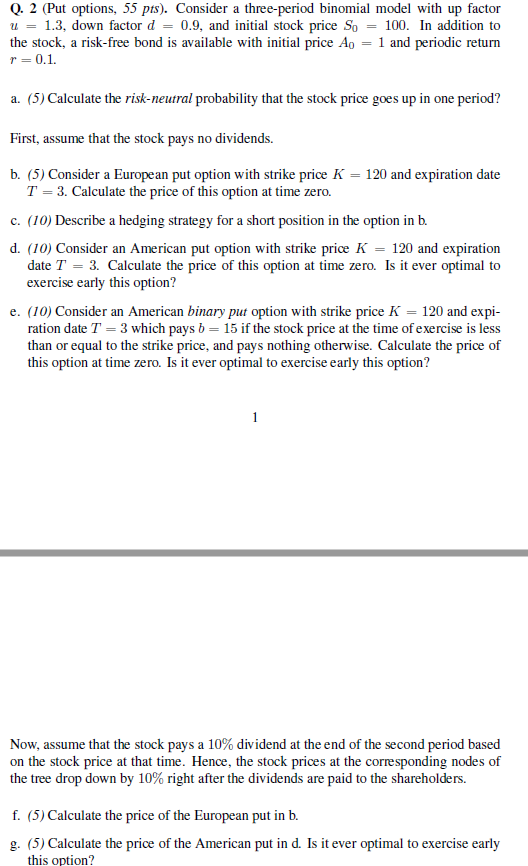

Q. 2 (Put options, 55 pts). Consider a three-period binomial model with up factor u = 1.3, down factor d = 0.9, and initial stock price So = 100. In addition to the stock, a risk-free bond is available with initial price Ag = 1 and periodic return r=0.1. a. (5) Calculate the risk-neutral probability that the stock price goes up in one period? First, assume that the stock pays no dividends. b. (5) Consider a European put option with strike price K = 120 and expiration date T = 3. Calculate the price of this option at time zero. C. (10) Describe a hedging strategy for a short position in the option in b. d. (10) Consider an American put option with strike price K = 120 and expiration date T = 3. Calculate the price of this option at time zero. Is it ever optimal to exercise early this option? e. (10) Consider an American binary put option with strike price K = 120 and expi- ration date T = 3 which pays b = 15 if the stock price at the time of exercise is less than or equal to the strike price, and pays nothing otherwise. Calculate the price of this option at time zero. Is it ever optimal to exercise early this option? 1 Now, assume that the stock pays a 10% dividend at the end of the second period based on the stock price at that time. Hence, the stock prices at the corresponding nodes of the tree drop down by 10% right after the dividends are paid to the shareholders. f. (5) Calculate the price of the European put in b. g. (5) Calculate the price of the American put in d. Is it ever optimal to exercise early this option? Q. 2 (Put options, 55 pts). Consider a three-period binomial model with up factor u = 1.3, down factor d = 0.9, and initial stock price So = 100. In addition to the stock, a risk-free bond is available with initial price Ag = 1 and periodic return r=0.1. a. (5) Calculate the risk-neutral probability that the stock price goes up in one period? First, assume that the stock pays no dividends. b. (5) Consider a European put option with strike price K = 120 and expiration date T = 3. Calculate the price of this option at time zero. C. (10) Describe a hedging strategy for a short position in the option in b. d. (10) Consider an American put option with strike price K = 120 and expiration date T = 3. Calculate the price of this option at time zero. Is it ever optimal to exercise early this option? e. (10) Consider an American binary put option with strike price K = 120 and expi- ration date T = 3 which pays b = 15 if the stock price at the time of exercise is less than or equal to the strike price, and pays nothing otherwise. Calculate the price of this option at time zero. Is it ever optimal to exercise early this option? 1 Now, assume that the stock pays a 10% dividend at the end of the second period based on the stock price at that time. Hence, the stock prices at the corresponding nodes of the tree drop down by 10% right after the dividends are paid to the shareholders. f. (5) Calculate the price of the European put in b. g. (5) Calculate the price of the American put in d. Is it ever optimal to exercise early this option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts