Question: Consider a portfolio allocation problem that is a special case of those we studied in class. An investor has initial wealth Y0=100. The investor allocates

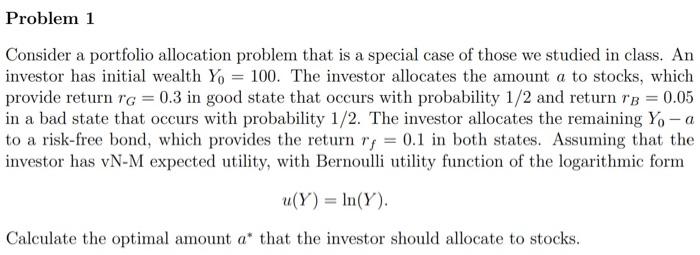

Consider a portfolio allocation problem that is a special case of those we studied in class. An investor has initial wealth Y0=100. The investor allocates the amount a to stocks, which provide return rG=0.3 in good state that occurs with probability 1/2 and return rB=0.05 in a bad state that occurs with probability 1/2. The investor allocates the remaining Y0a to a risk-free bond, which provides the return rf=0.1 in both states. Assuming that the investor has vN-M expected utility, with Bernoulli utility function of the logarithmic form u(Y)=ln(Y). Calculate the optimal amount a that the investor should allocate to stocks. Consider a portfolio allocation problem that is a special case of those we studied in class. An investor has initial wealth Y0=100. The investor allocates the amount a to stocks, which provide return rG=0.3 in good state that occurs with probability 1/2 and return rB=0.05 in a bad state that occurs with probability 1/2. The investor allocates the remaining Y0a to a risk-free bond, which provides the return rf=0.1 in both states. Assuming that the investor has vN-M expected utility, with Bernoulli utility function of the logarithmic form u(Y)=ln(Y). Calculate the optimal amount a that the investor should allocate to stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts