Question: Consider a portfolio allocation problem that is a special case of those we studied in class. An investor has initial wealth Y0=100. The investor allocates

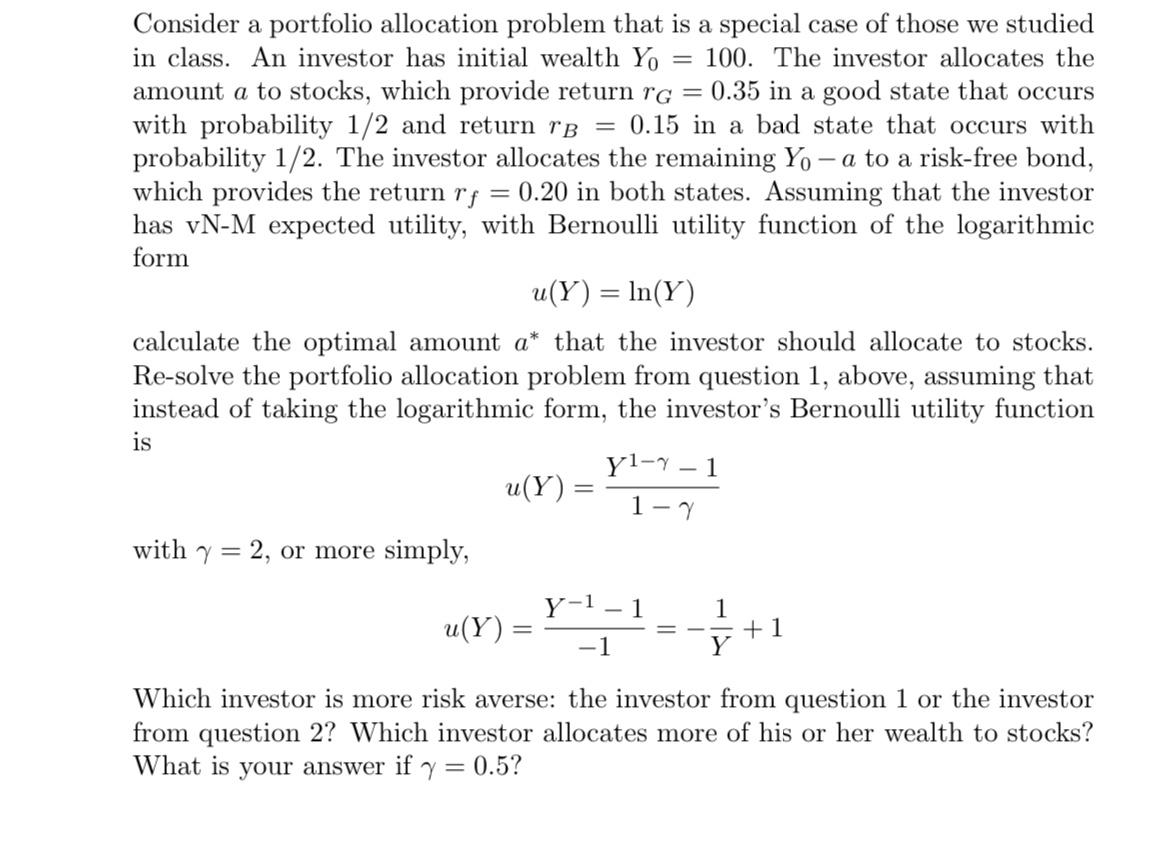

Consider a portfolio allocation problem that is a special case of those we studied in class. An investor has initial wealth Y0=100. The investor allocates the amount a to stocks, which provide return rG=0.35 in a good state that occurs with probability 1/2 and return rB=0.15 in a bad state that occurs with probability 1/2. The investor allocates the remaining Y0a to a risk-free bond, which provides the return rf=0.20 in both states. Assuming that the investor has vN-M expected utility, with Bernoulli utility function of the logarithmic form u(Y)=ln(Y) calculate the optimal amount a that the investor should allocate to stocks. Re-solve the portfolio allocation problem from question 1, above, assuming that instead of taking the logarithmic form, the investor's Bernoulli utility function is u(Y)=1Y11 with =2, or more simply, u(Y)=1Y11=Y1+1 Which investor is more risk averse: the investor from question 1 or the investor from question 2? Which investor allocates more of his or her wealth to stocks? What is your answer if =0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts