Question: = = = Consider a portfolio choice problem with a risk-free asset with return rf and two risky assets, the first with mean return Mi

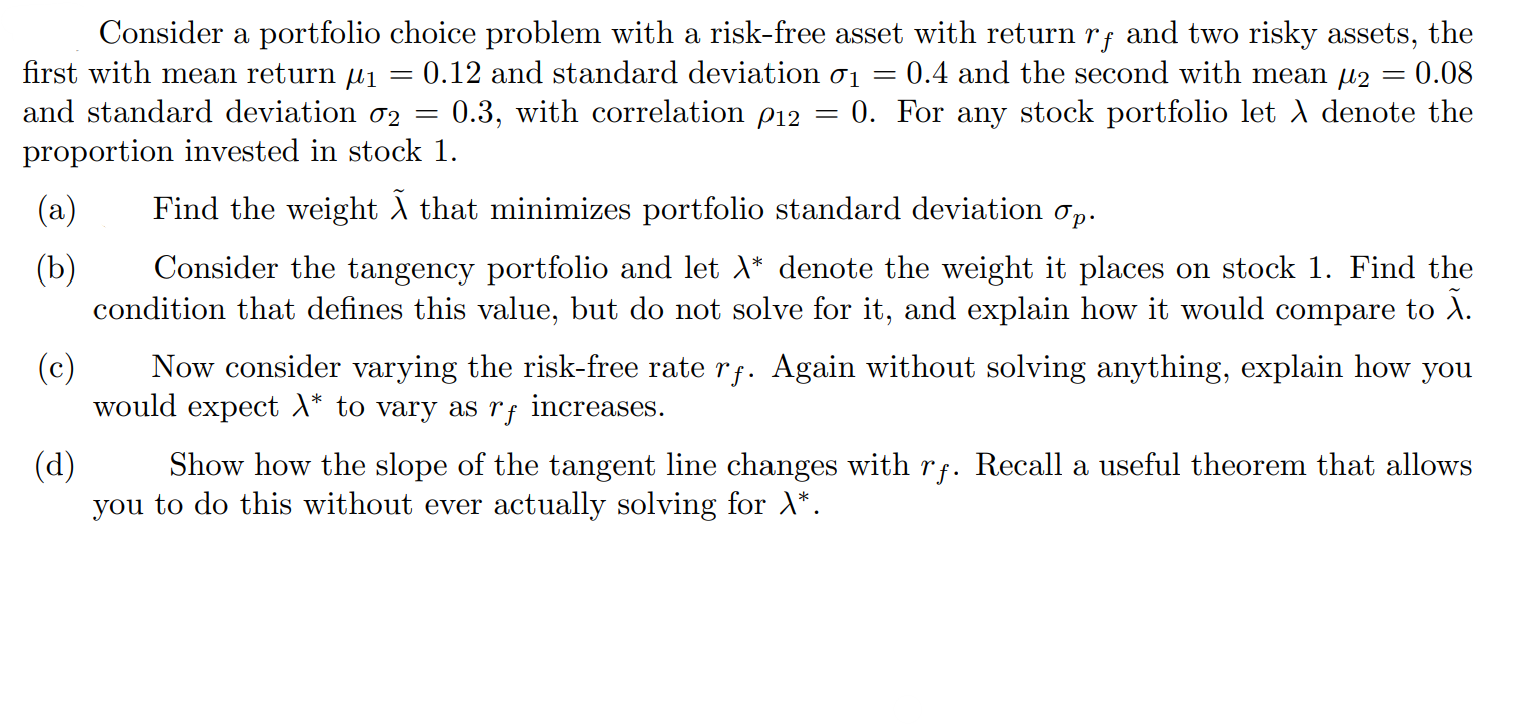

= = = Consider a portfolio choice problem with a risk-free asset with return rf and two risky assets, the first with mean return Mi 0.12 and standard deviation 01 = = 0.4 and the second with mean u2 0.08 and standard deviation 02 0.3, with correlation P12 0. For any stock portfolio let 1 denote the proportion invested in stock 1. (a) Find the weight that minimizes portfolio standard deviation Op. (b) Consider the tangency portfolio and let 1* denote the weight it places on stock 1. Find the condition that defines this value, but do not solve for it, and explain how it would compare to . (c) Now consider varying the risk-free rate rf. Again without solving anything, explain how you would expect 1* to vary as rf increases. (d) Show how the slope of the tangent line changes with rf. Recall a useful theorem that allows you to do this without ever actually solving for \*. = = = Consider a portfolio choice problem with a risk-free asset with return rf and two risky assets, the first with mean return Mi 0.12 and standard deviation 01 = = 0.4 and the second with mean u2 0.08 and standard deviation 02 0.3, with correlation P12 0. For any stock portfolio let 1 denote the proportion invested in stock 1. (a) Find the weight that minimizes portfolio standard deviation Op. (b) Consider the tangency portfolio and let 1* denote the weight it places on stock 1. Find the condition that defines this value, but do not solve for it, and explain how it would compare to . (c) Now consider varying the risk-free rate rf. Again without solving anything, explain how you would expect 1* to vary as rf increases. (d) Show how the slope of the tangent line changes with rf. Recall a useful theorem that allows you to do this without ever actually solving for \*

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts