Question: Consider a project that will generate free cash flows at year 1 of either $63,600,000 or $15,500,000. The probability of generating $63,600,000 is 68.9%. The

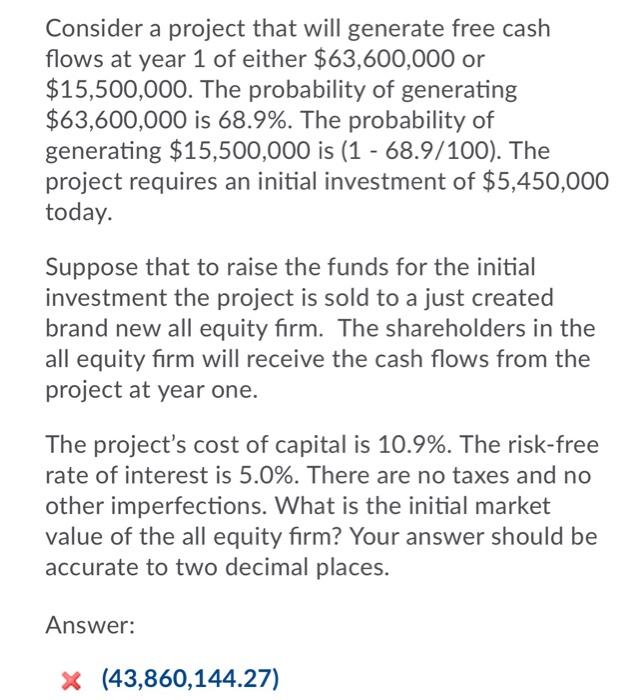

Consider a project that will generate free cash flows at year 1 of either $63,600,000 or $15,500,000. The probability of generating $63,600,000 is 68.9%. The probability of generating $15,500,000 is (1 - 68.9/100). The project requires an initial investment of $5,450,000 today. Suppose that to raise the funds for the initial investment the project is sold to a just created brand new all equity firm. The shareholders in the all equity firm will receive the cash flows from the project at year one. The project's cost of capital is 10.9%. The risk-free rate of interest is 5.0%. There are no taxes and no other imperfections. What is the initial market value of the all equity firm? Your answer should be accurate to two decimal places. Answer: x (43,860,144.27)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts