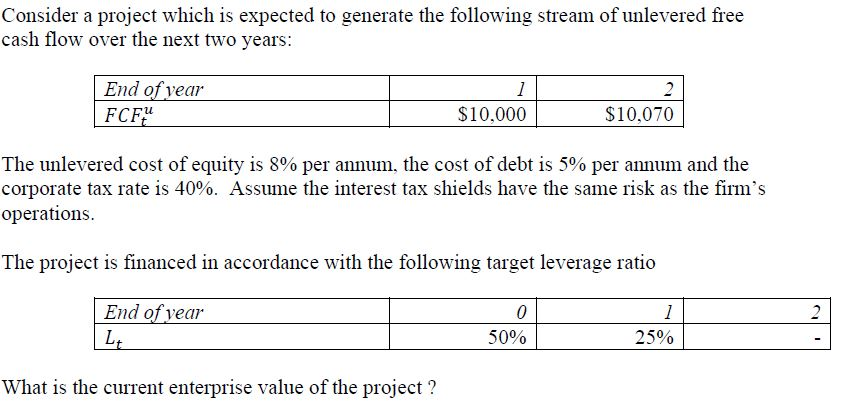

Question: Consider a project which is expected to generate the following stream of unlevered free cash flow over the next two years: End of vear FCF

Consider a project which is expected to generate the following stream of unlevered free cash flow over the next two years: End of vear FCF $10,000 $10,070 The unlevered cost of equity is 8% per annum, the cost of debt is 5% per annum and the corporate tax rate is 40%. Assume the interest tax shields have the same risk as the firm's operations. The project is financed in accordance with the following target leverage ratio End of year ILL soni 250 What is the current enterprise value of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts