Question: Consider a project which is expected to generate the following stream of unlevered free cash flow over the next five years: The project has been

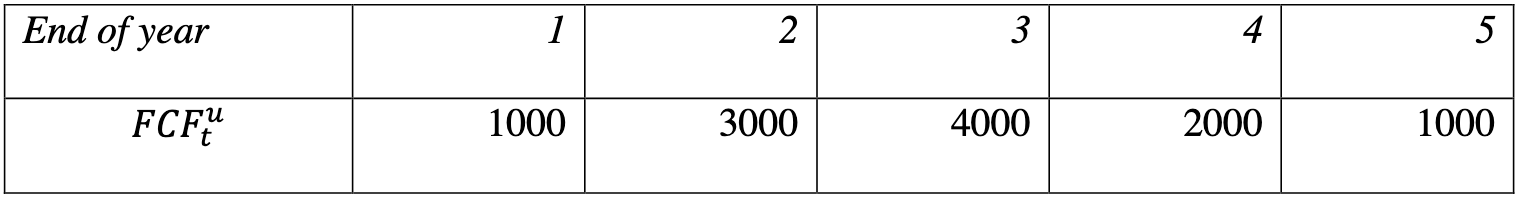

Consider a project which is expected to generate the following stream of unlevered free cash flow over the next five years:

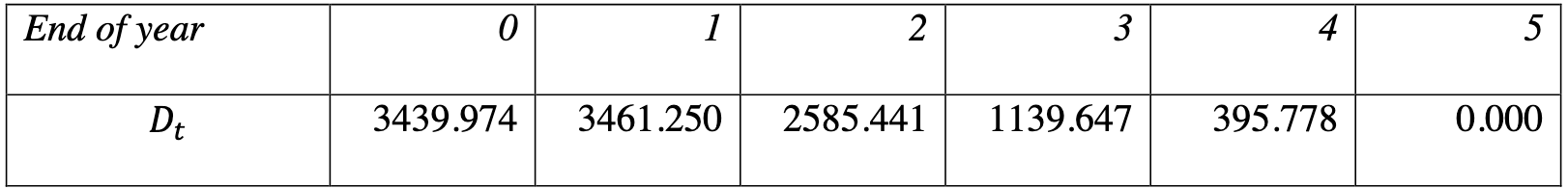

The project has been partly financed by bank debt in accordance with the following target debt schedule ..

The cost of equity is 20% per annum, the cost of debt is 10% per annum and the corporate tax rate is 40%. All dollar amounts are in $ millions. Use the FCFE model to calculate the current value of equity in the project.

End of year 1 2 3 4 5 FCF4 1000 3000 4000 2000 1000 End of year 0 1 2 3 4 5 Dt 3439.974 3461.250 2585.441 1139.647 395.778 0.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts