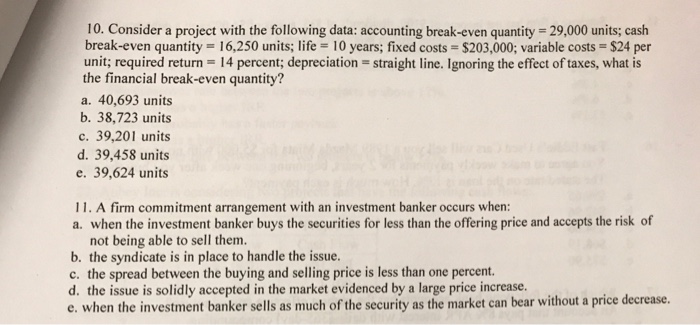

Question: Consider a project with the following data: accounting break-even quantity = 29,000 units; cash break-even quantity = 16, 250 units; life = 10 years; fixed

Consider a project with the following data: accounting break-even quantity = 29,000 units; cash break-even quantity = 16, 250 units; life = 10 years; fixed costs = $203,000; variable costs = $24 per unit; required return = 14 percent; depreciation = straight line. Ignoring the effect of taxes, what is the financial break-even quantity? a. 40, 693 units b. 38, 723 units c. 39, 201 units d. 39, 458 units e. 39, 624 units A firm commitment arrangement with an investment banker occurs when: a. when the investment banker buys the securities for less than the offering price and accepts the risk of not being able to sell them. b. the syndicate is in place to handle the issue. c. the spread between the buying and selling price is less than one percent. d. the issue is solidly accepted in the market evidenced by a large price increase. e. when the investment banker sells as much of the security as the market can bear without a price decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts