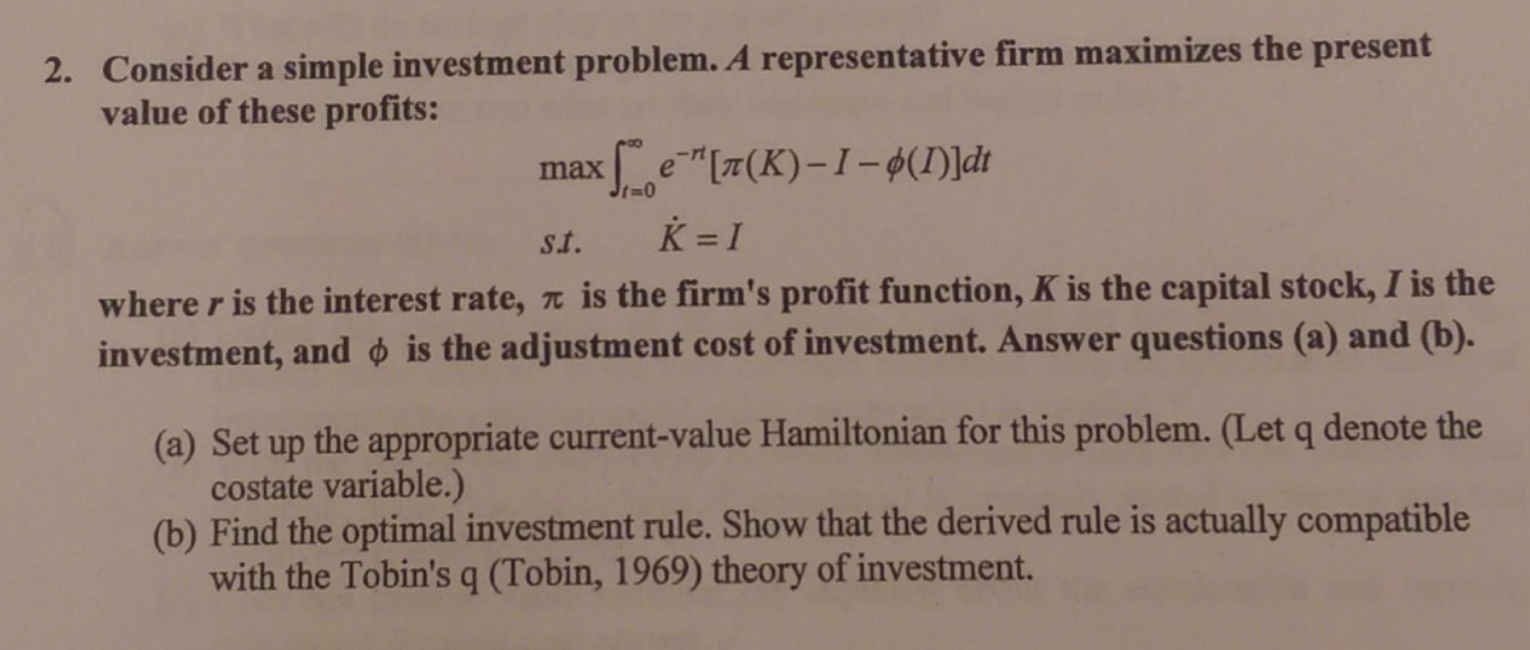

Question: Consider a simple investment problem. A representative firm maximizes the present value of these profits: max integral^infinity_t = 0 e^-rt [pi(K)-I- (I)]dt s.t. K =

Consider a simple investment problem. A representative firm maximizes the present value of these profits: max integral^infinity_t = 0 e^-rt [pi(K)-I- (I)]dt s.t. K = I where r is the interest rate, pi is the firm's profit function, K is the capital stock, I is the investment, and is the adjustment cost of investment. Answer questions and (b). Set up the appropriate current-value Hamiltonian for this problem. (Let q denote the costate variable.) Find the optimal investment rule. Show that the derived rule is actually compatible with the Tobin's q (Tobin, 1969) theory of investment. Consider a simple investment problem. A representative firm maximizes the present value of these profits: max integral^infinity_t = 0 e^-rt [pi(K)-I- (I)]dt s.t. K = I where r is the interest rate, pi is the firm's profit function, K is the capital stock, I is the investment, and is the adjustment cost of investment. Answer questions and (b). Set up the appropriate current-value Hamiltonian for this problem. (Let q denote the costate variable.) Find the optimal investment rule. Show that the derived rule is actually compatible with the Tobin's q (Tobin, 1969) theory of investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts