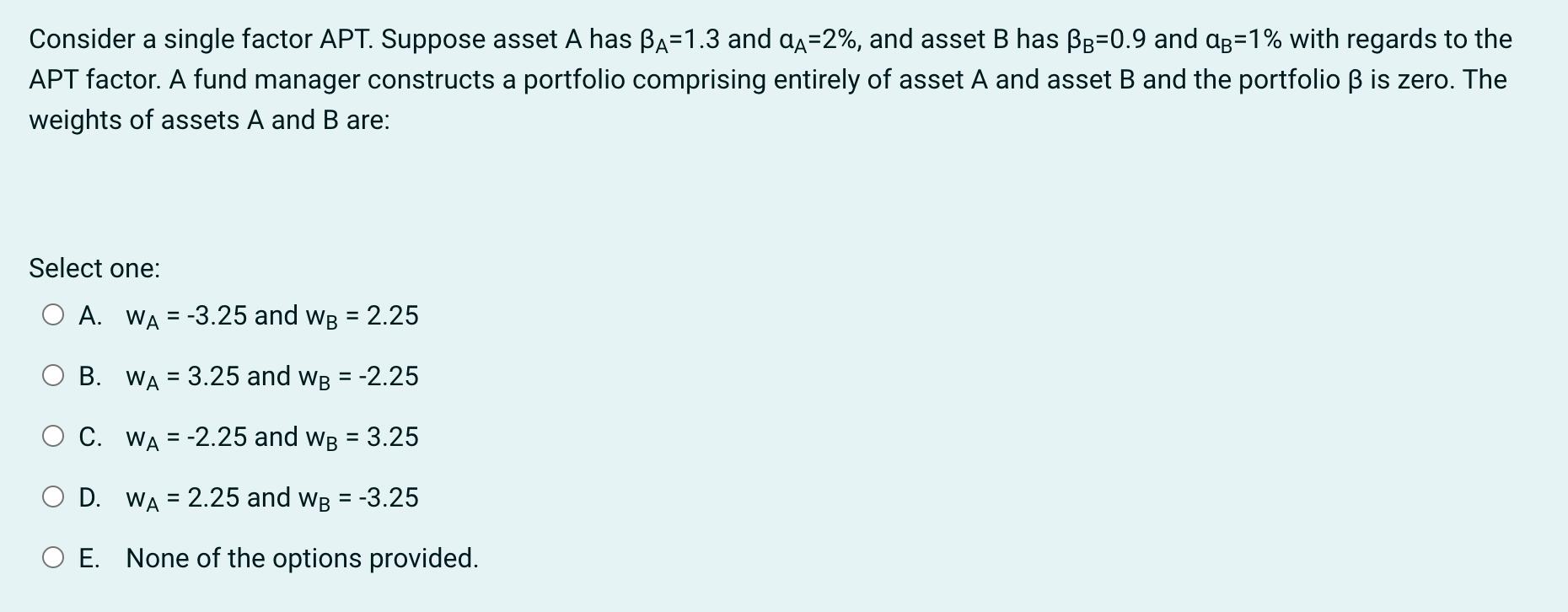

Question: Consider a single factor APT. Suppose asset A has BA=1.3 and =2%, and asset B has BB=0.9 and ag=1% with regards to the APT

Consider a single factor APT. Suppose asset A has BA=1.3 and =2%, and asset B has BB=0.9 and ag=1% with regards to the APT factor. A fund manager constructs a portfolio comprising entirely of asset A and asset B and the portfolio 3 is zero. The weights of assets A and B are: Select one: A. WA = -3.25 and WB = 2.25 B. O C. WA = 3.25 and WB = -2.25 WA-2.25 and WB = 3.25 D. WA = 2.25 and WB = -3.25 O E. None of the options provided.

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below In the Arbitrage Pricing Theo... View full answer

Get step-by-step solutions from verified subject matter experts