Question: Consider a stock priced at $30 with a standard deviation of 30%. The risk-free rate is 5%. There are put and call options available at

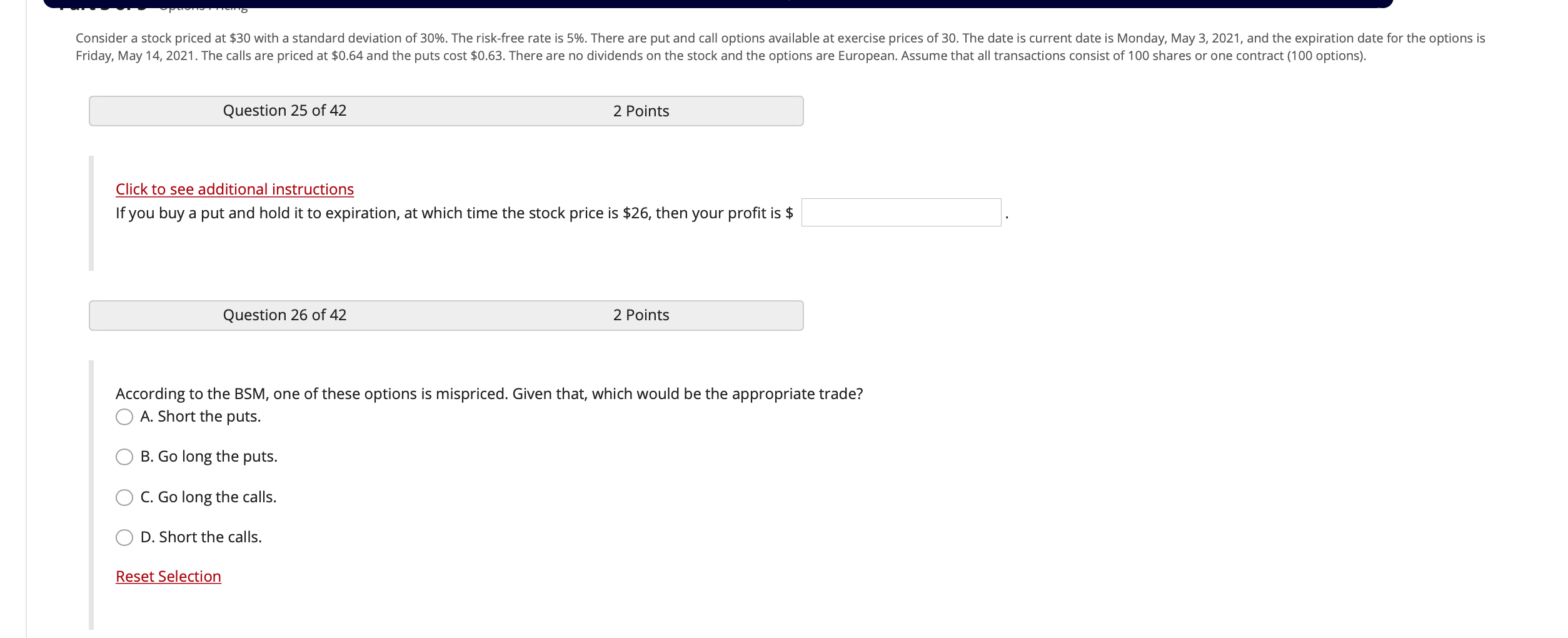

Consider a stock priced at $30 with a standard deviation of 30%. The risk-free rate is 5%. There are put and call options available at exercise prices of 30. The date is current date is Monday, May 3, 2021, and the expiration date for the options is Friday, May 14, 2021. The calls are priced at $0.64 and the puts cost $0.63. There are no dividends on the stock and the options are European. Assume that all transactions consist of 100 shares or one contract (100 options). Question 25 of 42 2 Points Click to see additional instructions If you buy a put and hold it to expiration, at which time the stock price is $26, then your profit is $ Question 26 of 42 2 Points According to the BSM, one of these options is mispriced. Given that, which would be the appropriate trade? A. Short the puts. B. Go long the puts. C. Go long the calls. D. Short the calls. Reset Selection Question 27 of 42 2 Points According to delta, if the stock goes up by ten cents, the call price should go up by about five cents. True False Reset Selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts