Question: Consider a three period binomial model (one initial date and two steps) as in class. Let the initial stock price be $100. Let the upward

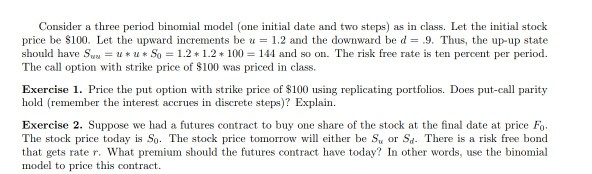

Consider a three period binomial model (one initial date and two steps) as in class. Let the initial stock price be $100. Let the upward increments be 1.2 and the downward be d.9. Thus, the up-up state should have Suu-u * u * So = 1.2 * 1.2 * 100-144 and so on. The risk free rate is ten percent per period. The call option with strike price of S100 was priced in class. Exercise 1. Price the put option with strike price of $100 using replicating portfolios. Does put-call parity hold remember the interest accrues in discrete steps)? Explain. Exercise 2. Suppose we had a futures contract to buy one share of the stock at the final date at price Fo The stock price today is So. The stock price tomorrowwill either be S or S. There is a risk free bond that gets rate r. What premium should the futures contract have today? In other words, use the binomial model to price this contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts