Question: Consider a three period model like the one we studied in class: - Time exists for three periods: t,t+1,t+2 - There exists an investment opportunity

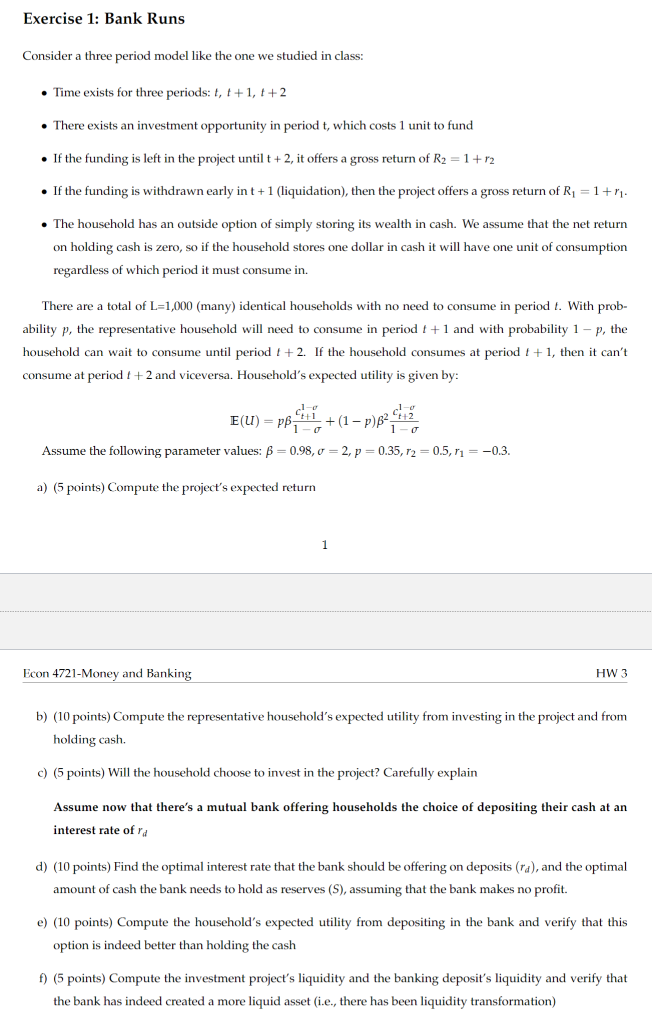

Consider a three period model like the one we studied in class: - Time exists for three periods: t,t+1,t+2 - There exists an investment opportunity in period t, which costs 1 unit to fund - If the funding is left in the project until t+2, it offers a gross return of R2=1+r2 - If the funding is withdrawn early in t+1 (liquidation), then the project offers a gross return of R1=1+r1. - The household has an outside option of simply storing its wealth in cash. We assume that the net return on holding cash is zero, so if the household stores one dollar in cash it will have one unit of consumption regardless of which period it must consume in. There are a total of L=1,000 (many) identical households with no need to consume in period t. With probability p, the representative household will need to consume in period t+1 and with probability 1p, the household can wait to consume until period t+2. If the household consumes at period t+1, then it can't consume at period t+2 and viceversa. Household's expected utility is given by: E(U)=p1ct+11+(1p)21ct+21 Assume the following parameter values: =0.98,=2,p=0.35,r2=0.5,r1=0.3. a) (5 points) Compute the project's expected return Econ 4721-Money and Banking HW 3 b) (10 points) Compute the representative household's expected utility from investing in the project and from holding cash. c) (5 points) Will the household choose to invest in the project? Carefully explain Assume now that there's a mutual bank offering households the choice of depositing their cash at an interest rate of rd d) (10 points) Find the optimal interest rate that the bank should be offering on deposits (rd), and the optimal amount of cash the bank needs to hold as reserves (S), assuming that the bank makes no profit. e) (10 points) Compute the household's expected utility from depositing in the bank and verify that this option is indeed better than holding the cash f) (5 points) Compute the investment project's liquidity and the banking deposit's liquidity and verify that the bank has indeed created a more liquid asset (i.e., there has been liquidity transformation) Consider a three period model like the one we studied in class: - Time exists for three periods: t,t+1,t+2 - There exists an investment opportunity in period t, which costs 1 unit to fund - If the funding is left in the project until t+2, it offers a gross return of R2=1+r2 - If the funding is withdrawn early in t+1 (liquidation), then the project offers a gross return of R1=1+r1. - The household has an outside option of simply storing its wealth in cash. We assume that the net return on holding cash is zero, so if the household stores one dollar in cash it will have one unit of consumption regardless of which period it must consume in. There are a total of L=1,000 (many) identical households with no need to consume in period t. With probability p, the representative household will need to consume in period t+1 and with probability 1p, the household can wait to consume until period t+2. If the household consumes at period t+1, then it can't consume at period t+2 and viceversa. Household's expected utility is given by: E(U)=p1ct+11+(1p)21ct+21 Assume the following parameter values: =0.98,=2,p=0.35,r2=0.5,r1=0.3. a) (5 points) Compute the project's expected return Econ 4721-Money and Banking HW 3 b) (10 points) Compute the representative household's expected utility from investing in the project and from holding cash. c) (5 points) Will the household choose to invest in the project? Carefully explain Assume now that there's a mutual bank offering households the choice of depositing their cash at an interest rate of rd d) (10 points) Find the optimal interest rate that the bank should be offering on deposits (rd), and the optimal amount of cash the bank needs to hold as reserves (S), assuming that the bank makes no profit. e) (10 points) Compute the household's expected utility from depositing in the bank and verify that this option is indeed better than holding the cash f) (5 points) Compute the investment project's liquidity and the banking deposit's liquidity and verify that the bank has indeed created a more liquid asset (i.e., there has been liquidity transformation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts