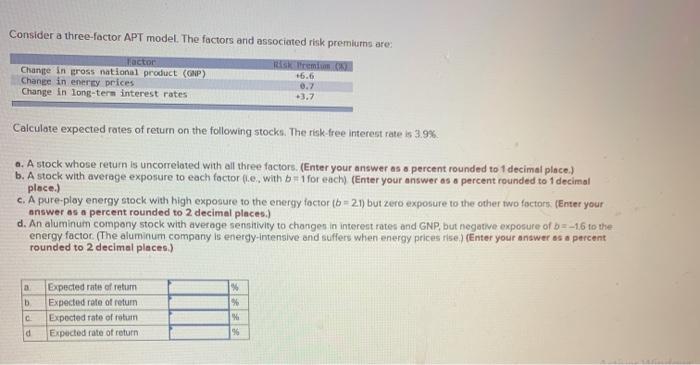

Question: Consider a three-factor APT model. The factors and associated risk premiums are: actor Change in gross national product (GNP) Change in energy prices Change in

Consider a three-factor APT model. The factors and associated risk premiums are: actor Change in gross national product (GNP) Change in energy prices Change in long-term interest rates 16.6 0.7 Calculate expected rates of return on the following stocks. The risk free interest rate is 3.9% a. A stock whose return is uncorrelated with all three factors. (Enter your answer as a percent rounded to 1 decimal place.) b. A stock with average exposure to each factor (e. with bei for each) (Enter your answer as a percent rounded to 1 decimal place.) c. A pure-play energy stock with high exposure to the energy foctor (b=21) but zero exposure to the other two factors (Enter your answer as a percent rounded to 2 decimal places.) d. An aluminum company stock with average sensitivity to changes in interest rates and GNP, but negative exposure of b=-16 to the energy factor. The aluminum company is energy-Intensive and suffers when energy prices rise) (Enter your answer as a percent rounded to 2 decimal places.) Expected rate of retum Expected rate of return Expected rate of return Expected rate of return % % M 96 d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts