Question: Consider a two-period binomial model in which a stock trades currently at $44. The stock price can go up 6% or down 6% each

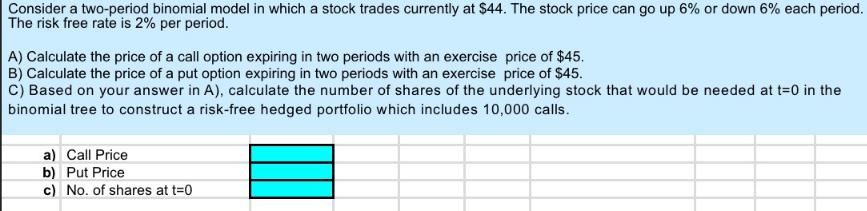

Consider a two-period binomial model in which a stock trades currently at $44. The stock price can go up 6% or down 6% each period. The risk free rate is 2% per period. A) Calculate the price of a call option expiring in two periods with an exercise price of $45. B) Calculate the price of a put option expiring in two periods with an exercise price of $45. C) Based on your answer in A), calculate the number of shares of the underlying stock that would be needed at t=0 in the binomial tree to construct a risk-free hedged portfolio which includes 10,000 calls. a) Call Price b) Put Price c) No. of shares at t=0 Consider a two-period binomial model in which a stock trades currently at $44. The stock price can go up 6% or down 6% each period. The risk free rate is 2% per period. A) Calculate the price of a call option expiring in two periods with an exercise price of $45. B) Calculate the price of a put option expiring in two periods with an exercise price of $45. C) Based on your answer in A), calculate the number of shares of the underlying stock that would be needed at t=0 in the binomial tree to construct a risk-free hedged portfolio which includes 10,000 calls. a) Call Price b) Put Price c) No. of shares at t=0 Consider a two-period binomial model in which a stock trades currently at $44. The stock price can go up 6% or down 6% each period. The risk free rate is 2% per period. A) Calculate the price of a call option expiring in two periods with an exercise price of $45. B) Calculate the price of a put option expiring in two periods with an exercise price of $45. C) Based on your answer in A), calculate the number of shares of the underlying stock that would be needed at t=0 in the binomial tree to construct a risk-free hedged portfolio which includes 10,000 calls. a) Call Price b) Put Price c) No. of shares at t=0

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

To calculate the prices of the call and put options in this twoperiod binomial model we can use the riskneutral pricing approach Lets break down each ... View full answer

Get step-by-step solutions from verified subject matter experts