Question: Consider a two-period binomial model in which the current stock price of 90 can each period either go up by 20 percent or down

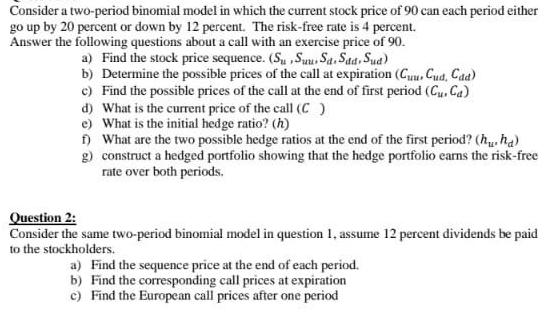

Consider a two-period binomial model in which the current stock price of 90 can each period either go up by 20 percent or down by 12 percent. The risk-free rate is 4 percent. Answer the following questions about a call with an exercise price of 90. a) Find the stock price sequence. (Su,Suu. Sa. Sad. Sud) b) Determine the possible prices of the call at expiration (Cuu. Cud, Cad) c) Find the possible prices of the call at the end of first period (Cu, Ca) d) What is the current price of the call (C) e) What is the initial hedge ratio? (h) f) What are the two possible hedge ratios at the end of the first period? (h,ha) g) construct a hedged portfolio showing that the hedge portfolio earns the risk-free rate over both periods. Question 2: Consider the same two-period binomial model in question 1, assume 12 percent dividends be paid to the stockholders. a) Find the sequence price at the end of each period. b) Find the corresponding call prices at expiration c) Find the European call prices after one period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts