Question: Consider a two-period economy with 2 securities, Lambda (security 1) and Omega (security 2), which are both in unit supply. They are traded in

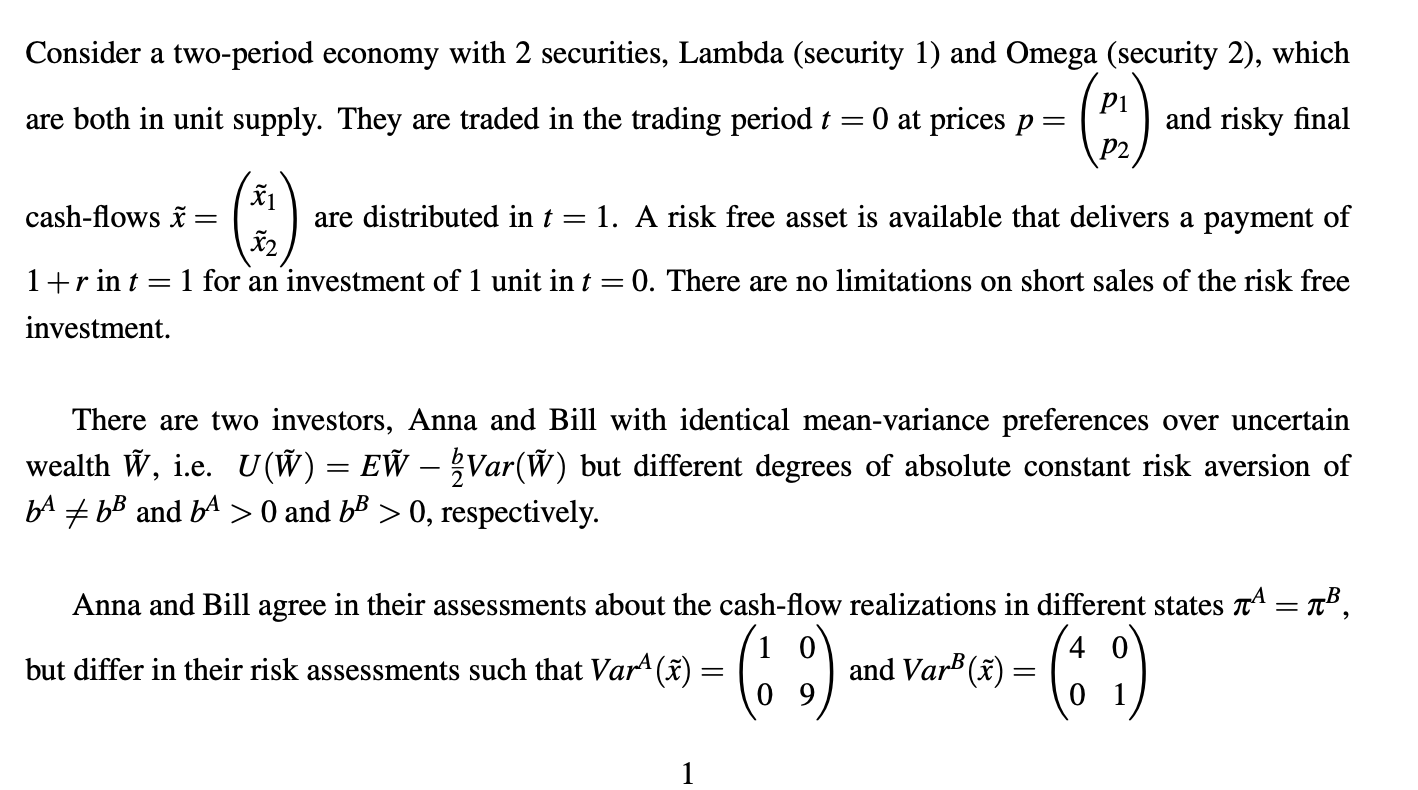

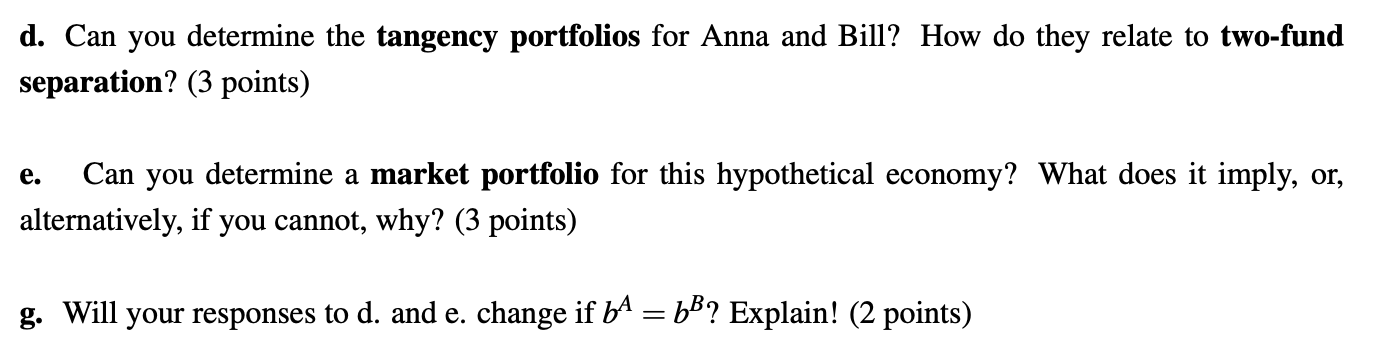

Consider a two-period economy with 2 securities, Lambda (security 1) and Omega (security 2), which are both in unit supply. They are traded in the trading period t = 0 at prices p= cash-flows x 1+rint= investment. = x1 x2 and risky final P2 are distributed in t = 1. A risk free asset is available that delivers a payment of for an investment of 1 unit in t = 0. There are no limitations on short sales of the risk free There are two investors, Anna and Bill with identical mean-variance preferences over uncertain wealth , i.e. U() = E Var() but different degrees of absolute constant risk aversion of bA bB and bA > 0 and bB > 0, respectively. Anna and Bill agree in their assessments about the cash-flow realizations in different states = , but differ in their risk assessments such that Var^ (x) = 4 1 and Var (x)= 9 0 (6 %) = d. Can you determine the tangency portfolios for Anna and Bill? How do they relate to two-fund separation? (3 points) e. Can you determine a market portfolio for this hypothetical economy? What does it imply, or, alternatively, if you cannot, why? (3 points) g. Will your responses to d. and e. change if b = b? Explain! (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts