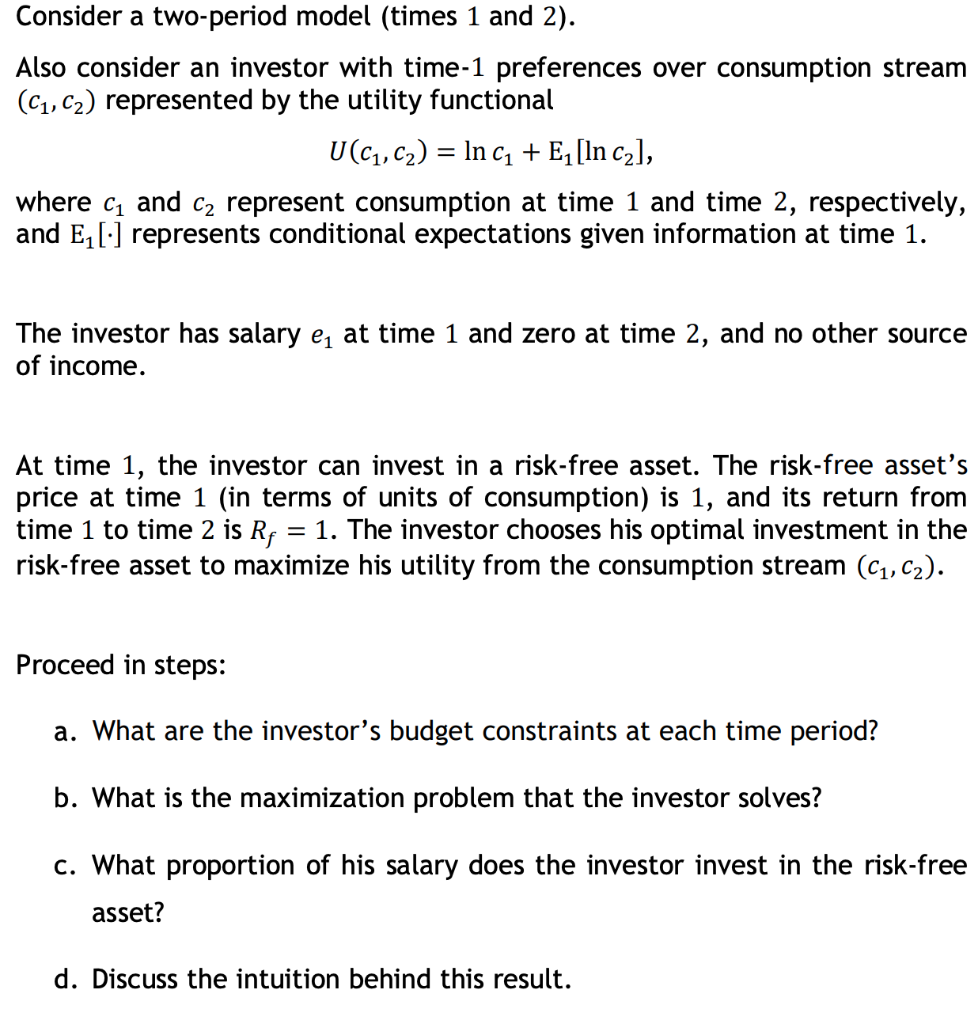

Question: Consider a two-period model (times 1 and 2). Also consider an investor with time-1 preferences over consumption stream (c1,c2) represented by the utility functional U(c1,c2)=lnc1+E1[lnc2]

Consider a two-period model (times 1 and 2). Also consider an investor with time-1 preferences over consumption stream (c1,c2) represented by the utility functional U(c1,c2)=lnc1+E1[lnc2] where c1 and c2 represent consumption at time 1 and time 2, respectively, and E1[] represents conditional expectations given information at time 1 . The investor has salary e1 at time 1 and zero at time 2 , and no other source of income. At time 1, the investor can invest in a risk-free asset. The risk-free asset's price at time 1 (in terms of units of consumption) is 1 , and its return from time 1 to time 2 is Rf=1. The investor chooses his optimal investment in the risk-free asset to maximize his utility from the consumption stream (c1,c2). Proceed in steps: a. What are the investor's budget constraints at each time period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts