Question: please solve asap Question 3 Consider a two-period model (times 1 and 2). Also consider an investor with time- 1 preferences over consumption stream (c1,c2)

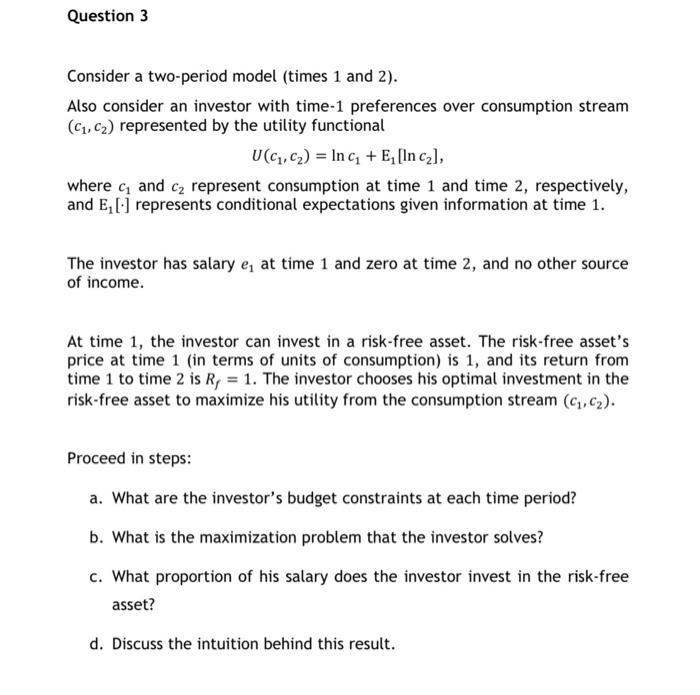

Question 3 Consider a two-period model (times 1 and 2). Also consider an investor with time- 1 preferences over consumption stream (c1,c2) represented by the utility functional U(c1,c2)=lnc1+E1[lnc2] where c1 and c2 represent consumption at time 1 and time 2, respectively, and E1[] represents conditional expectations given information at time 1 . The investor has salary e1 at time 1 and zero at time 2 , and no other source of income. At time 1 , the investor can invest in a risk-free asset. The risk-free asset's price at time 1 (in terms of units of consumption) is 1 , and its return from time 1 to time 2 is Rf=1. The investor chooses his optimal investment in the risk-free asset to maximize his utility from the consumption stream (c1,c2). Proceed in steps: a. What are the investor's budget constraints at each time period? b. What is the maximization problem that the investor solves? c. What proportion of his salary does the investor invest in the risk-free asset? d. Discuss the intuition behind this result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts