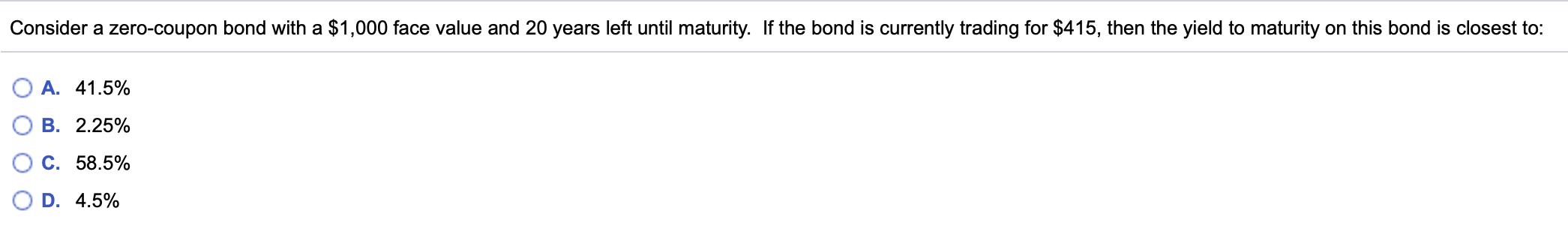

Question: Consider a zero-coupon bond with a $1,000 face value and 20 years left until maturity. If the bond is currently trading for $415, then the

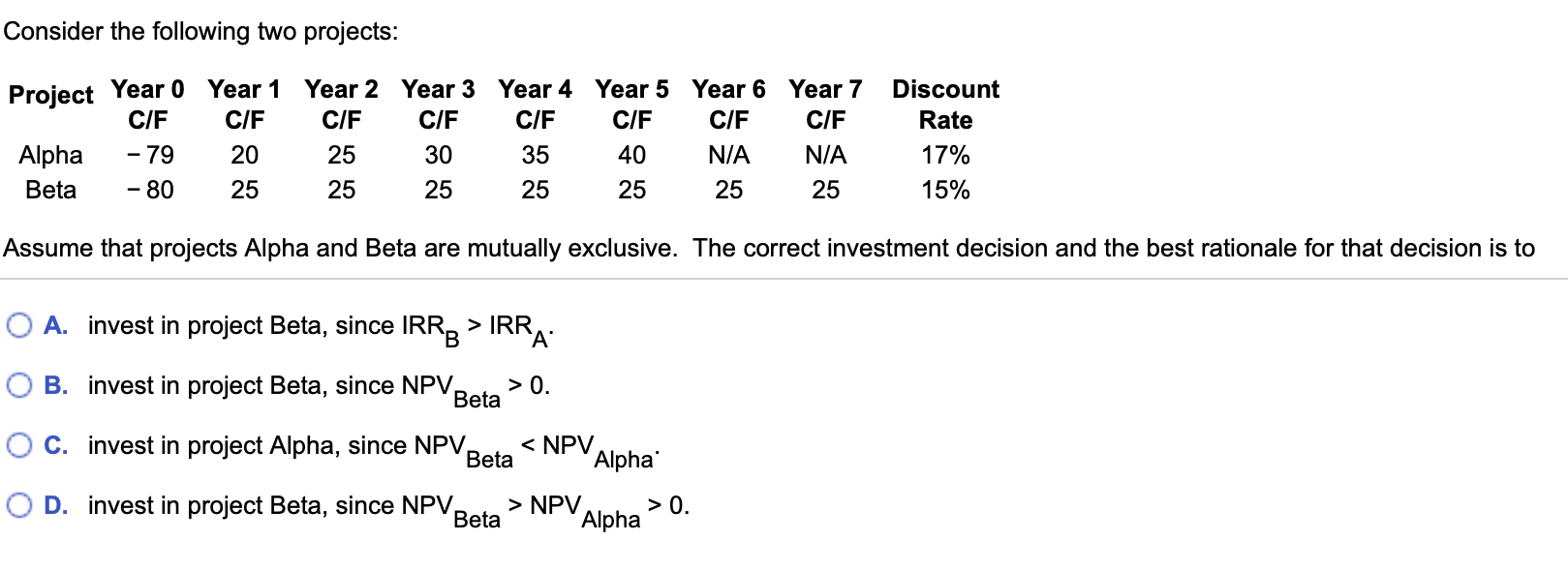

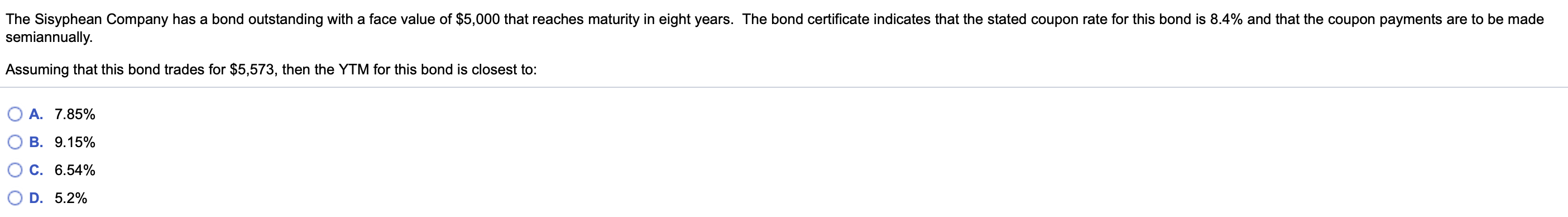

Consider a zero-coupon bond with a $1,000 face value and 20 years left until maturity. If the bond is currently trading for $415, then the yield to maturity on this bond is closest to: O A. 41.5% B. 2.25% C. 58.5% OD. 4.5% Consider the following two projects: Project Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 C/F C/F C/F C/F C/F C/F C/F C/F Alpha - 79 20 25 30 35 40 N/A Beta -80 25 25 25 25 25 25 25 Discount Rate 17% 15% Assume that projects Alpha and Beta are mutually exclusive. The correct investment decision and the best rationale for that decision is to O A. invest in project Beta, since IRRB > IRRA OB. invest in project Beta, since NPV >0. Beta O C. invest in project Alpha, since NPV NPV >0. Beta Alpha The Sisyphean Company has a bond outstanding with a face value of $5,000 that reaches maturity in eight years. The bond certificate indicates that the stated coupon rate for this bond is 8.4% and that the coupon payments are to be made semiannually. Assuming that this bond trades for $5,573, then the YTM for this bond is closest to: O A. 7.85% B. 9.15% C. 6.54% D. 5.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts