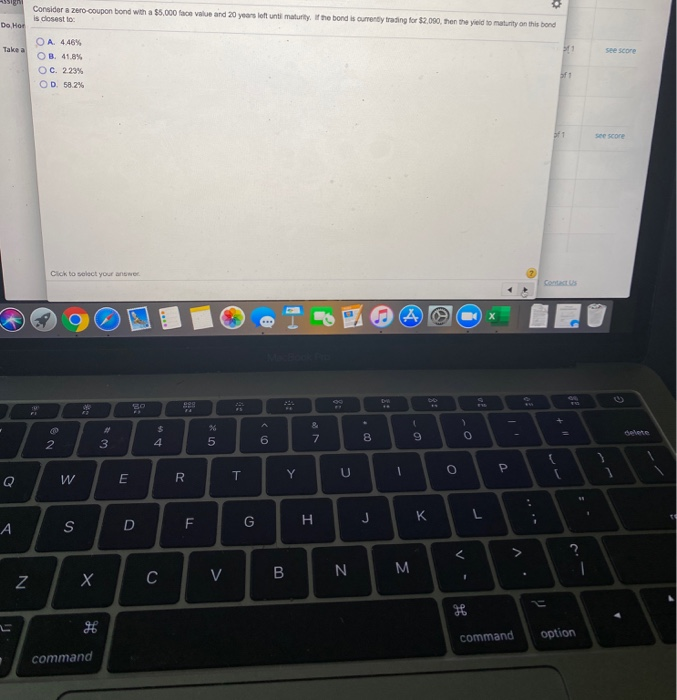

Question: Consider a zero-coupon bond with a $5.000 face value and 20 years loft unti maturity, the bond is currently trading for $2.000, then the yield

Consider a zero-coupon bond with a $5.000 face value and 20 years loft unti maturity, the bond is currently trading for $2.000, then the yield to maturity on this bond is closest to Do Hot Take a 11 see score O A 4 46% OB. 41.8% OC. 2.23% OD 58.2% of 1 1 See score Click to select your answer x 50 See 8: - TO & 7 $ 4 die 0 8 9 02 2 3 5 o P U W E R Y T K J L H S F G D > M C V N. B N pi H command option command

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock