Question: Consider an asset allocation problem with one risky asset and one risk-free asset .There are four investors .Each investor maximizes a mean-variance utility function to

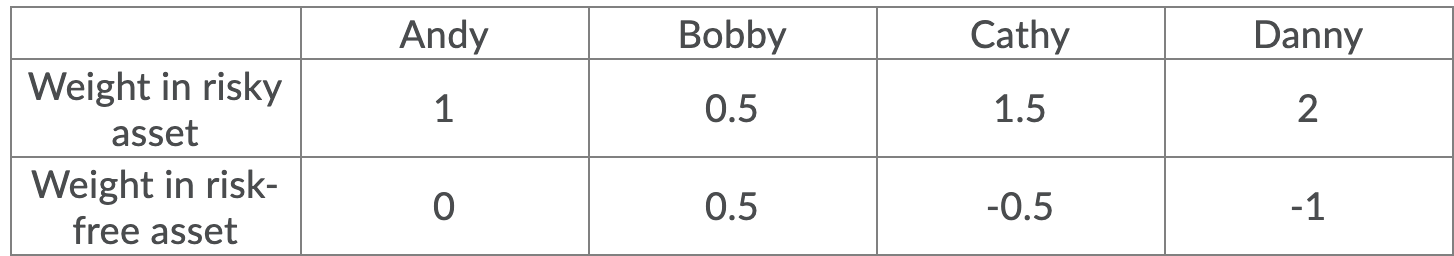

Consider an asset allocation problem with one risky asset and one risk-free asset .There are four investors .Each investor maximizes a mean-variance utility function to make their optimal investment decision. Consequently, the optimal weights in the risky asset and the risk-free asset by the four investors are given in the following table .Given the information, who is likely to be the most risk-averse investor among the four?

Weight in risky asset Weight in risk- free asset Andy 1 0 Bobby 0.5 0.5 Cathy 1.5 -0.5 Danny 2 -1

Step by Step Solution

There are 3 Steps involved in it

To determine the most riskaverse investor among the four we need to compare the wei... View full answer

Get step-by-step solutions from verified subject matter experts