Question: Consider an idealised world in which there are only two risky assets D and E and a risk-free asset F. Suppose the capital asset pricing

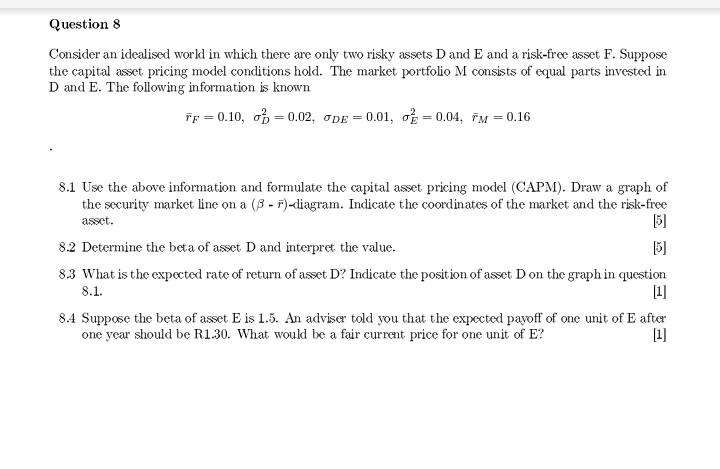

Consider an idealised world in which there are only two risky assets D and E and a risk-free asset F. Suppose the capital asset pricing model conditions hold. The market portfolio M consists of equal parts invested in D and E. The following information is known rF=0.10,D2=0.02,DE=0.01,E2=0.04,rM=0.16 8.1 Use the above information and formulate the capital asset pricing model (CAPM). Draw a graph of the security market line on a (r)-diagram. Indicate the coordinates of the market and the risk-free asset. [5] 8.2 Determine the beta of asset D and interpret the value. [5] 8.3 What is the expected rate of return of asset D ? Indicate the position of asset D on the graph in question 8.1. [1] 8.4 Suppose the beta of asset E is 1.5. An adviser told you that the expected payoff of one unit of E after one year should be R1.30. What would be a fair current price for one unit of E? [1]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts