Question: Consider an individual with utility function: U(W) = W. She has an initial wealth of $100 tied up in assets which are subject to loss.

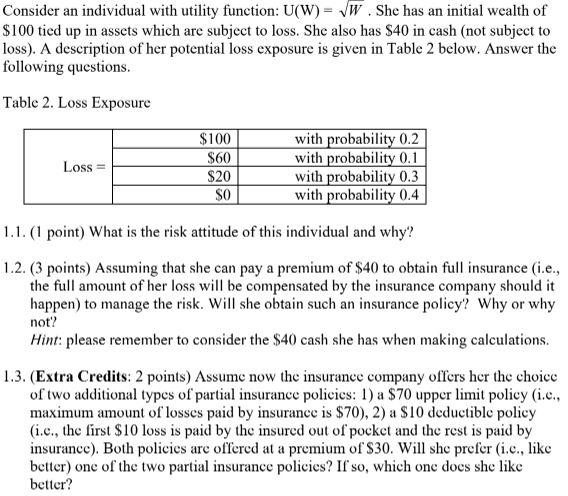

Consider an individual with utility function: U(W) = W. She has an initial wealth of $100 tied up in assets which are subject to loss. She also has $40 in cash (not subject to loss). A description of her potential loss exposure is given in Table 2 below. Answer the following questions. Table 2. Loss Exposure Loss $100 $60 $20 SO with probability 0.2 with probability 0.1 with probability 0.3 with probability 0.4 1.1. (1 point) What is the risk attitude of this individual and why? 1.2. (3 points) Assuming that she can pay a premium of $40 to obtain full insurance (i.e., the full amount of her loss will be compensated by the insurance company should it happen) to manage the risk. Will she obtain such an insurance policy? Why or why not? Hint: please remember to consider the $40 cash she has when making calculations. 1.3. (Extra Credits: 2 points) Assume now the insurance company offers her the choice of two additional types of partial insurance policies: 1) a $70 upper limit policy (i.c., maximum amount of losses paid by insurance is $70), 2) a $10 deductible policy (i.c., the first $10 loss is paid by the insured out of pocket and the rest is paid by insurance). Both policies are offered at a premium of $30. Will she prefer (i.c., like better) one of the two partial insurance policies? If so, which one does she like better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts