Question: Consider an n=3 step binomial tree with T=.5. Suppose r, the annualized risk-free rate is 4%, and delta, the annualized dividend rate is 2%. Also

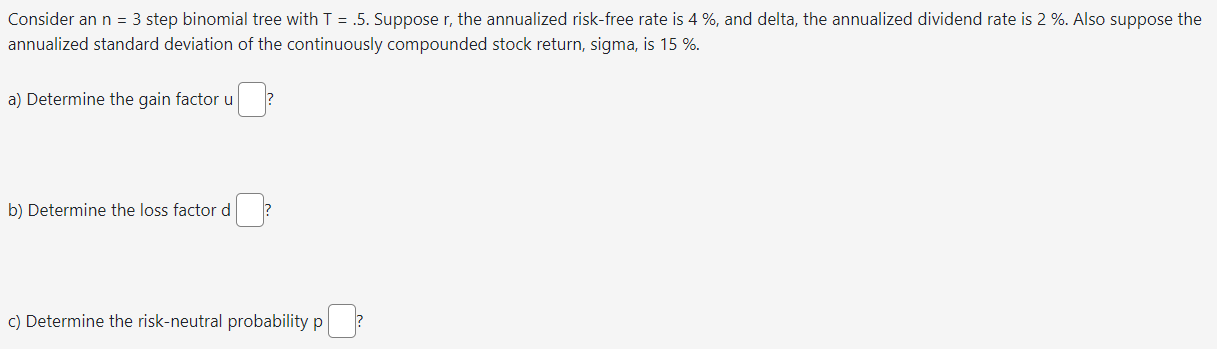

Consider an n=3 step binomial tree with T=.5. Suppose r, the annualized risk-free rate is 4%, and delta, the annualized dividend rate is 2%. Also suppose the annualized standard deviation of the continuously compounded stock return, sigma, is 15%. a) Determine the gain factor u? b) Determine the loss factor d? c) Determine the risk-neutral probability p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts