Question: Consider an option on a commodity which has a positive net convenience yield. The commodity has a current price of So and the futures

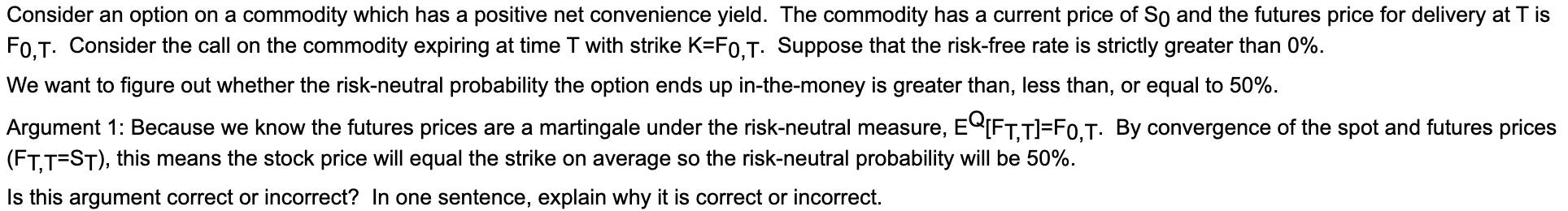

Consider an option on a commodity which has a positive net convenience yield. The commodity has a current price of So and the futures price for delivery at T is FO,T. Consider the call on the commodity expiring at time T with strike K=F0,T. Suppose that the risk-free rate is strictly greater than 0%. We want to figure out whether the risk-neutral probability the option ends up in-the-money is greater than, less than, or equal to 50%. Argument 1: Because we know the futures prices are a martingale under the risk-neutral measure, EQ[FT,T]=FO,T. By convergence of the spot and futures prices (FT,T=ST), this means the stock price will equal the strike on average so the risk-neutral probability will be 50%. Is this argument correct or incorrect? In one sentence, explain why it is correct or incorrect.

Step by Step Solution

There are 3 Steps involved in it

Answer This argument is incorrect because it assumes that the expect... View full answer

Get step-by-step solutions from verified subject matter experts