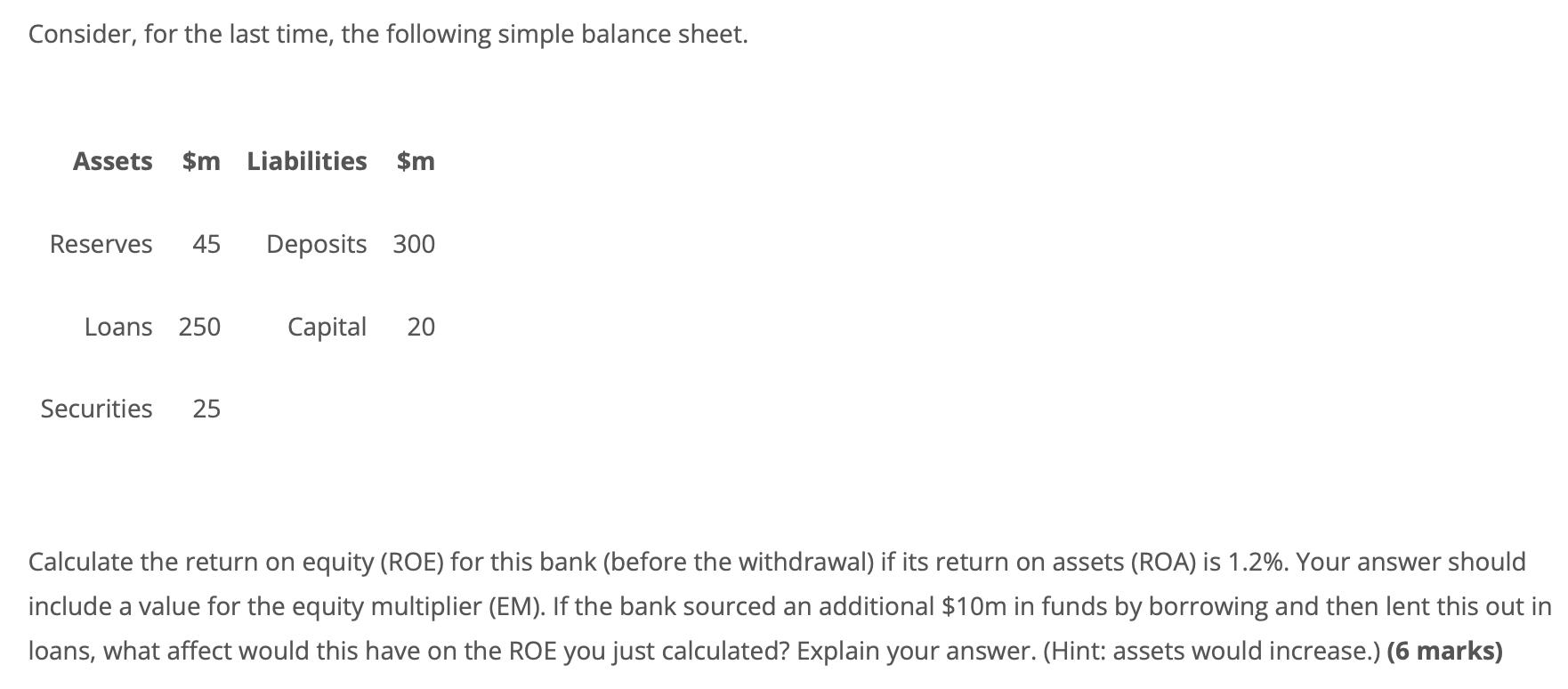

Question: Consider, for the last time, the following simple balance sheet. Assets $m Liabilities $m Reserves 45 Deposits 300 Loans 250 Capital 20 Securities 25

Consider, for the last time, the following simple balance sheet. Assets $m Liabilities $m Reserves 45 Deposits 300 Loans 250 Capital 20 Securities 25 Calculate the return on equity (ROE) for this bank (before the withdrawal) if its return on assets (ROA) is 1.2%. Your answer should include a value for the equity multiplier (EM). If the bank sourced an additional $10m in funds by borrowing and then lent this out in loans, what affect would this have on the ROE you just calculated? Explain your answer. (Hint: assets would increase.) (6 marks)

Step by Step Solution

3.57 Rating (150 Votes )

There are 3 Steps involved in it

The total assets of the bank are 45m 250m 25m 320m ROA Net Income Total Assets Ne... View full answer

Get step-by-step solutions from verified subject matter experts