Question: Consider how the SCI and SFP for Black would differ from the statements provided if Black reported its investment in White on the equity basis.

Consider how the SCI and SFP for Black would differ from the statements provided if Black reported its investment in White on the equity basis. Determine the following:

- Sales

- Dividend income

- Cost of sales

- Depreciation expense

- Income tax expense

- Other expenses

- Equity in White's earnings

- Retained earnings, December 31, 2019

- Dividends

- Retained earnings, December 31, 2020

- Cash

- Accounts and other receivable

- Inventories

- Building and equipment

- Accumulated depreciation

- Investment in White

- Other investments

- Accounts and other payables

- Deferred income taxes

- Common shares

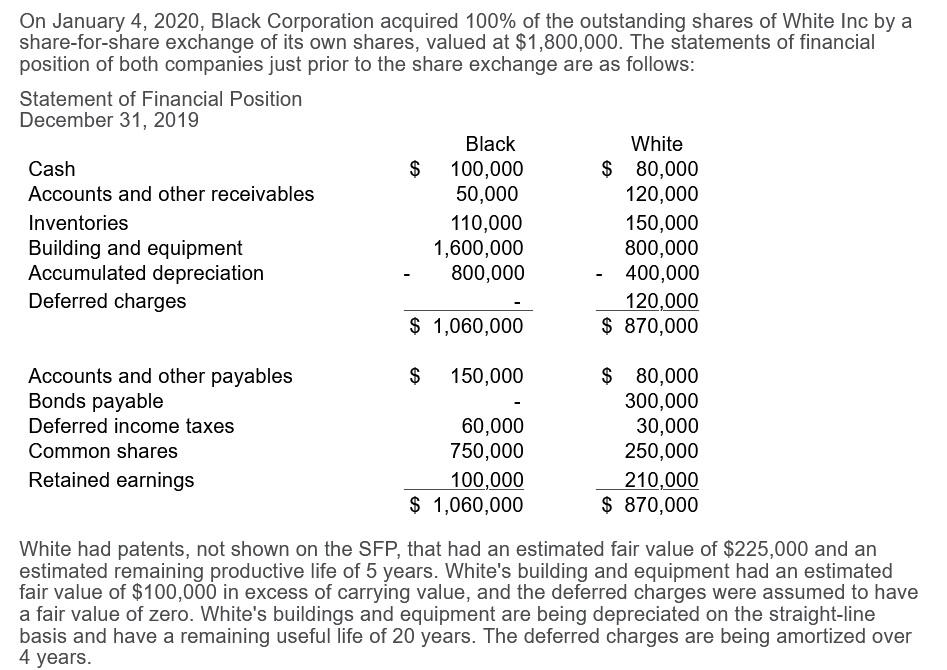

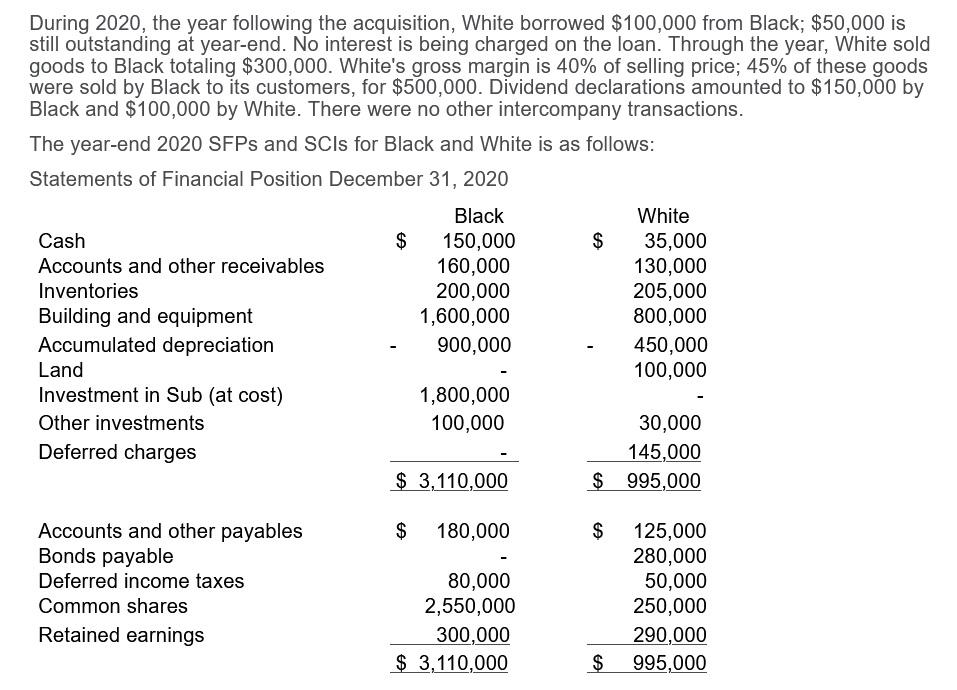

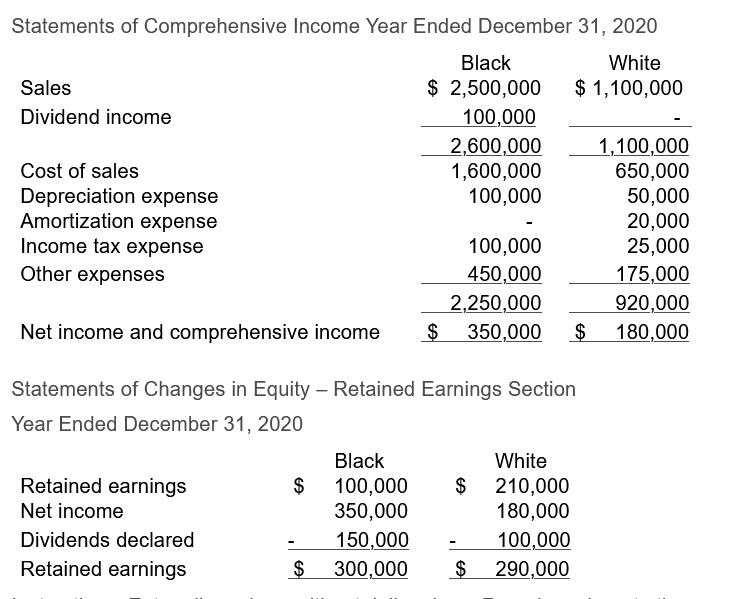

On January 4, 2020, Black Corporation acquired 100% of the outstanding shares of White Inc by a share-for-share exchange of its own shares, valued at $1,800,000. The statements of financial position of both companies just prior to the share exchange are as follows: Statement of Financial Position December 31, 2019 Black White Cash $ 100,000 $ 80,000 Accounts and other receivables 50,000 120,000 Inventories 110,000 150,000 Building and equipment 1,600,000 800,000 Accumulated depreciation 800,000 400,000 Deferred charges 120,000 $ 1,060,000 $ 870,000 $ 150,000 Accounts and other payables Bonds payable Deferred income taxes Common shares Retained earnings 60,000 750,000 100,000 $ 1,060,000 $ 80,000 300,000 30,000 250,000 210,000 $ 870,000 White had patents, not shown on the SFP, that had an estimated fair value of $225,000 and an estimated remaining productive life of 5 years. White's building and equipment had an estimated fair value of $100,000 in excess of carrying value, and the deferred charges were assumed to have a fair value of zero. White's buildings and equipment are being depreciated on the straight-line basis and have a remaining useful life of 20 years. The deferred charges are being amortized over 4 years. $ During 2020, the year following the acquisition, White borrowed $100,000 from Black; $50,000 is still outstanding at year-end. No interest is being charged on the loan. Through the year, White sold goods to Black totaling $300,000. White's gross margin is 40% of selling price; 45% of these goods were sold by Black to its customers, for $500,000. Dividend declarations amounted to $150,000 by Black and $100,000 by White. There were no other intercompany transactions. The year-end 2020 SFPs and SCIs for Black and White is as follows: Statements of Financial Position December 31, 2020 Black White Cash 150,000 $ 35,000 Accounts and other receivables 160,000 130,000 Inventories 200,000 205,000 Building and equipment 1,600,000 800,000 Accumulated depreciation 900,000 450,000 Land 100,000 Investment in Sub (at cost) 1,800,000 Other investments 100,000 30,000 Deferred charges 145,000 $ 3,110,000 $ 995,000 $ 180,000 $ Accounts and other payables Bonds payable Deferred income taxes Common shares Retained earnings 80,000 2,550,000 300,000 $ 3,110,000 125,000 280,000 50,000 250,000 290,000 995,000 $ Statements of Comprehensive Income Year Ended December 31, 2020 Black White Sales $ 2,500,000 $ 1,100,000 Dividend income 100,000 2,600,000 1,100,000 Cost of sales 1,600,000 650,000 Depreciation expense 100,000 50,000 Amortization expense 20,000 Income tax expense 100,000 25,000 Other expenses 450,000 175,000 2,250,000 920,000 Net income and comprehensive income $ 350,000 $ 180,000 Statements of Changes in Equity - Retained Earnings Section Year Ended December 31, 2020 Black White Retained earnings $ 100,000 $ $ 210,000 Net income 350,000 180,000 Dividends declared 150,000 100,000 Retained earnings $ 300,000 $ 290,000 On January 4, 2020, Black Corporation acquired 100% of the outstanding shares of White Inc by a share-for-share exchange of its own shares, valued at $1,800,000. The statements of financial position of both companies just prior to the share exchange are as follows: Statement of Financial Position December 31, 2019 Black White Cash $ 100,000 $ 80,000 Accounts and other receivables 50,000 120,000 Inventories 110,000 150,000 Building and equipment 1,600,000 800,000 Accumulated depreciation 800,000 400,000 Deferred charges 120,000 $ 1,060,000 $ 870,000 $ 150,000 Accounts and other payables Bonds payable Deferred income taxes Common shares Retained earnings 60,000 750,000 100,000 $ 1,060,000 $ 80,000 300,000 30,000 250,000 210,000 $ 870,000 White had patents, not shown on the SFP, that had an estimated fair value of $225,000 and an estimated remaining productive life of 5 years. White's building and equipment had an estimated fair value of $100,000 in excess of carrying value, and the deferred charges were assumed to have a fair value of zero. White's buildings and equipment are being depreciated on the straight-line basis and have a remaining useful life of 20 years. The deferred charges are being amortized over 4 years. $ During 2020, the year following the acquisition, White borrowed $100,000 from Black; $50,000 is still outstanding at year-end. No interest is being charged on the loan. Through the year, White sold goods to Black totaling $300,000. White's gross margin is 40% of selling price; 45% of these goods were sold by Black to its customers, for $500,000. Dividend declarations amounted to $150,000 by Black and $100,000 by White. There were no other intercompany transactions. The year-end 2020 SFPs and SCIs for Black and White is as follows: Statements of Financial Position December 31, 2020 Black White Cash 150,000 $ 35,000 Accounts and other receivables 160,000 130,000 Inventories 200,000 205,000 Building and equipment 1,600,000 800,000 Accumulated depreciation 900,000 450,000 Land 100,000 Investment in Sub (at cost) 1,800,000 Other investments 100,000 30,000 Deferred charges 145,000 $ 3,110,000 $ 995,000 $ 180,000 $ Accounts and other payables Bonds payable Deferred income taxes Common shares Retained earnings 80,000 2,550,000 300,000 $ 3,110,000 125,000 280,000 50,000 250,000 290,000 995,000 $ Statements of Comprehensive Income Year Ended December 31, 2020 Black White Sales $ 2,500,000 $ 1,100,000 Dividend income 100,000 2,600,000 1,100,000 Cost of sales 1,600,000 650,000 Depreciation expense 100,000 50,000 Amortization expense 20,000 Income tax expense 100,000 25,000 Other expenses 450,000 175,000 2,250,000 920,000 Net income and comprehensive income $ 350,000 $ 180,000 Statements of Changes in Equity - Retained Earnings Section Year Ended December 31, 2020 Black White Retained earnings $ 100,000 $ $ 210,000 Net income 350,000 180,000 Dividends declared 150,000 100,000 Retained earnings $ 300,000 $ 290,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts