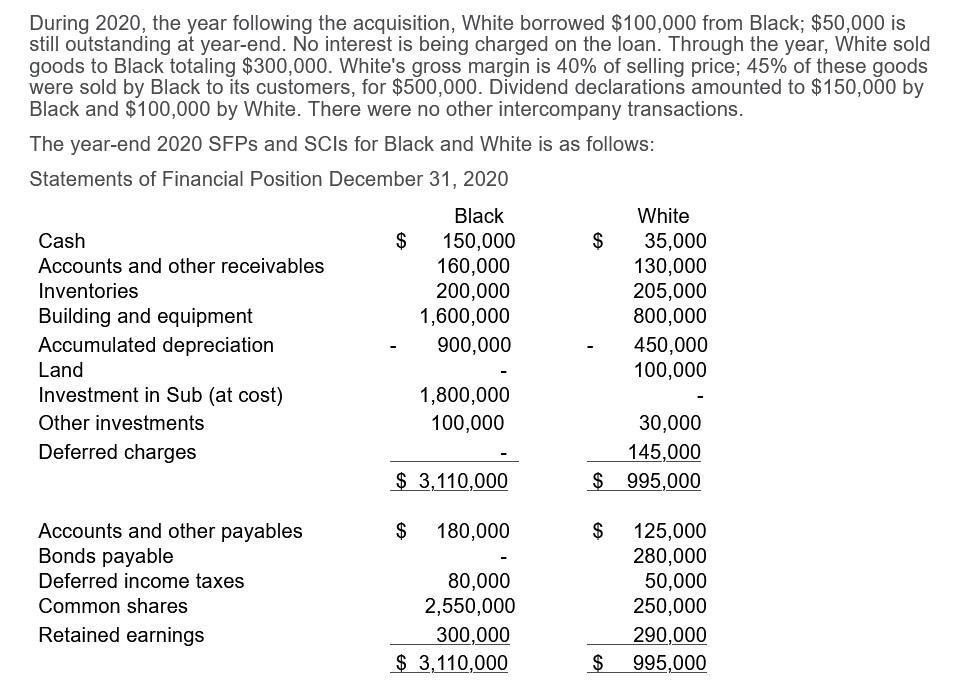

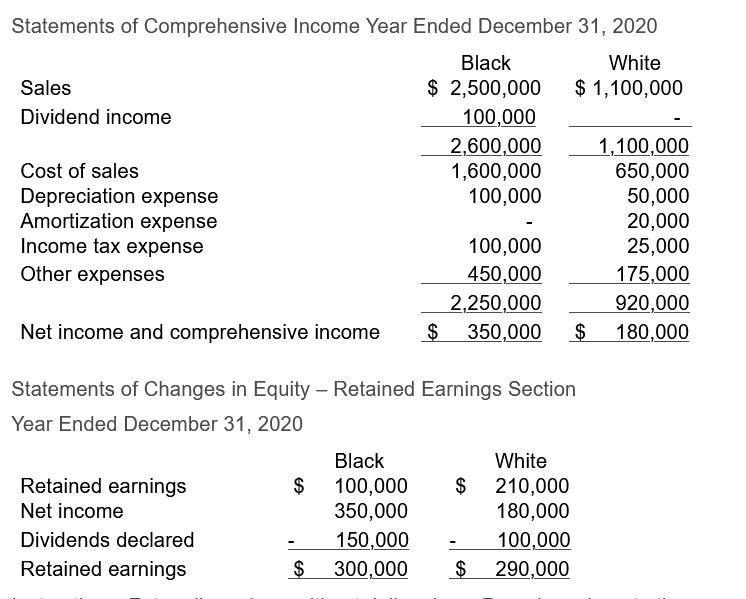

Question: Consider how the SCI and SFP for Black would differ from the statements provided if Black reported its investment in White on an equity basis.

Consider how the SCI and SFP for Black would differ from the statements provided if Black reported its investment in White on an equity basis. Determine the following:

- Sales

- Dividend income

- Cost of sales

- Depreciation expense

- Income tax expense

- Other expenses

- Equity in White's earnings

- Retained earnings, December 31, 2019

- Dividends

- Retained earnings, December 31, 2020

- Cash

- Accounts and other receivable

- Inventories

- Building and equipment

- Accumulated depreciation

- Investment in White

- Other investments

- Accounts and other payables

- Deferred income taxes

- Common shares

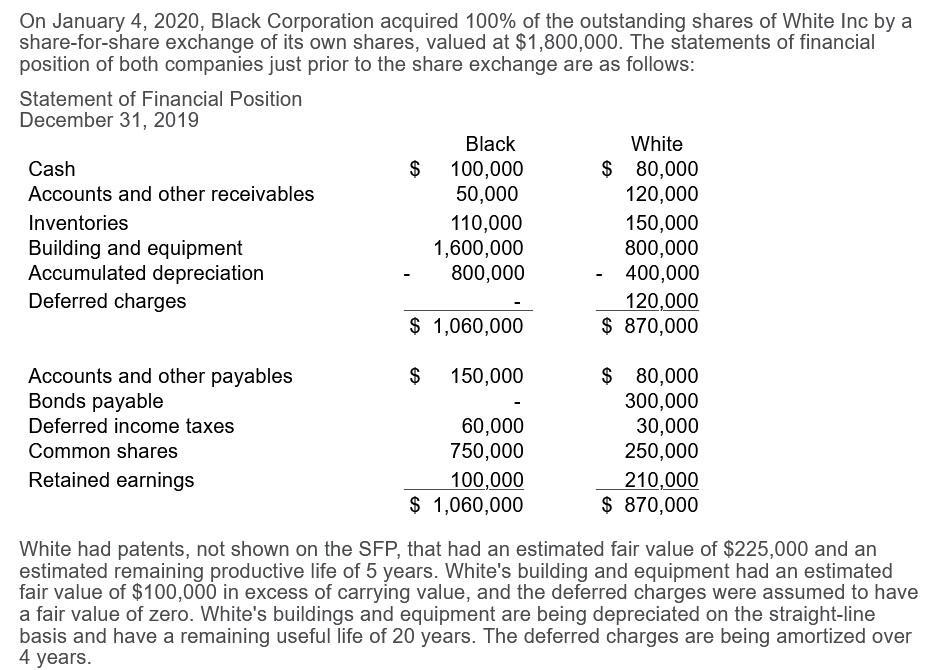

On January 4, 2020, Black Corporation acquired 100% of the outstanding shares of White Inc by a share-for-share exchange of its own shares, valued at $1,800,000. The statements of financial position of both companies just prior to the share exchange are as follows: Statement of Financial Position December 31, 2019 Black White $ 80,000 120,000 Cash $ 100,000 Accounts and other receivables 50,000 150,000 800,000 400,000 120,000 $ 870,000 Inventories Building and equipment Accumulated depreciation Deferred charges 110,000 1,600,000 800,000 $ 1,060,000 $ 80,000 300,000 30,000 250,000 Accounts and other payables Bonds payable $ 150,000 Deferred income taxes 60,000 750,000 Common shares Retained earnings 100,000 $ 1,060,000 210,000 $ 870,000 White had patents, not shown on the SFP, that had an estimated fair value of $225,000 and an estimated remaining productive life of 5 years. White's building and equipment had an estimated fair value of $100,000 in excess of carrying value, and the deferred charges were assumed to have a fair value of zero. White's buildings and equipment are being depreciated on the straight-line basis and have a remaining useful life of 20 years. The deferred charges are being amortized over 4 years.

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

BLACK Statement of Comprehensive Income for the year ended 31st December 2020 Equity Basis Sales 250... View full answer

Get step-by-step solutions from verified subject matter experts