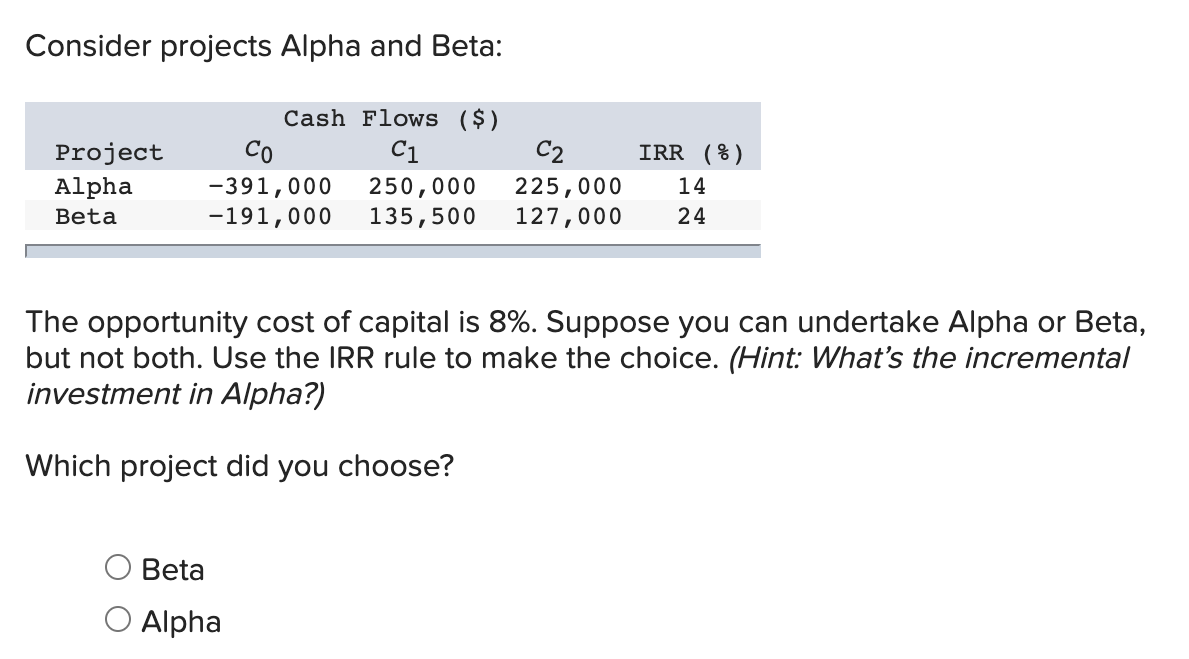

Question: Consider projects Alpha and Beta: Project Alpha Beta Cash Flows ($) Ci -391,000 250,000 -191,000 135,500 C2 225,000 127,000 IRR (%) 14 24 The opportunity

Consider projects Alpha and Beta: Project Alpha Beta Cash Flows ($) Ci -391,000 250,000 -191,000 135,500 C2 225,000 127,000 IRR (%) 14 24 The opportunity cost of capital is 8%. Suppose you can undertake Alpha or Beta, but not both. Use the IRR rule to make the choice. (Hint: What's the incremental investment in Alpha?) Which project did you choose? Beta O Alpha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts