Question: looking for help with question 4 A and B 3) Chapter 7. Exercise 13 Voice River, Inc. is interested in estimating its weighted average cost

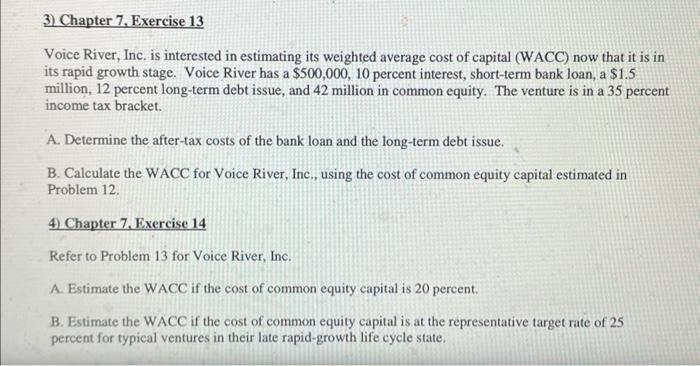

3) Chapter 7. Exercise 13 Voice River, Inc. is interested in estimating its weighted average cost of capital (WACC) now that it is in its rapid growth stage. Voice River has a $500,000, 10 percent interest, short-term bank loan, a $1.5 million, 12 percent long-term debt issue, and 42 million in common equity. The venture is in a 35 percent income tax bracket. a A. Determine the after-tax costs of the bank loan and the long-term debt issue. B. Calculate the WACC for Voice River, Inc., using the cost of common equity capital estimated in Problem 12. 4) Chapter 7. Exercise 14 Refer to Problem 13 for Voice River, Inc. A. Estimate the WACC if the cost of common equity capital is 20 percent. B. Estimate the WACC if the cost of common equity capital is at the representative target rate of 25 percent for typical ventures in their late rapid-growth life cycle state

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts