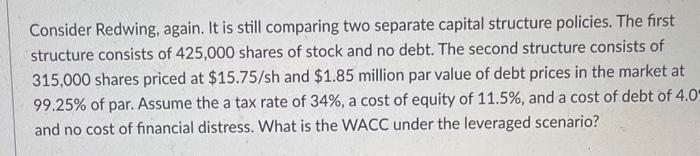

Question: Consider Redwing, again. It is still comparing two separate capital structure policies. The first structure consists of 425,000 shares of stock and no debt. The

Consider Redwing, again. It is still comparing two separate capital structure policies. The first structure consists of 425,000 shares of stock and no debt. The second structure consists of 315,000 shares priced at $15.75/ sh and $1.85 million par value of debt prices in the market at 99.25% of par. Assume the a tax rate of 34%, a cost of equity of 11.5%, and a cost of debt of 4.0 and no cost of financial distress. What is the WACC under the leveraged scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts