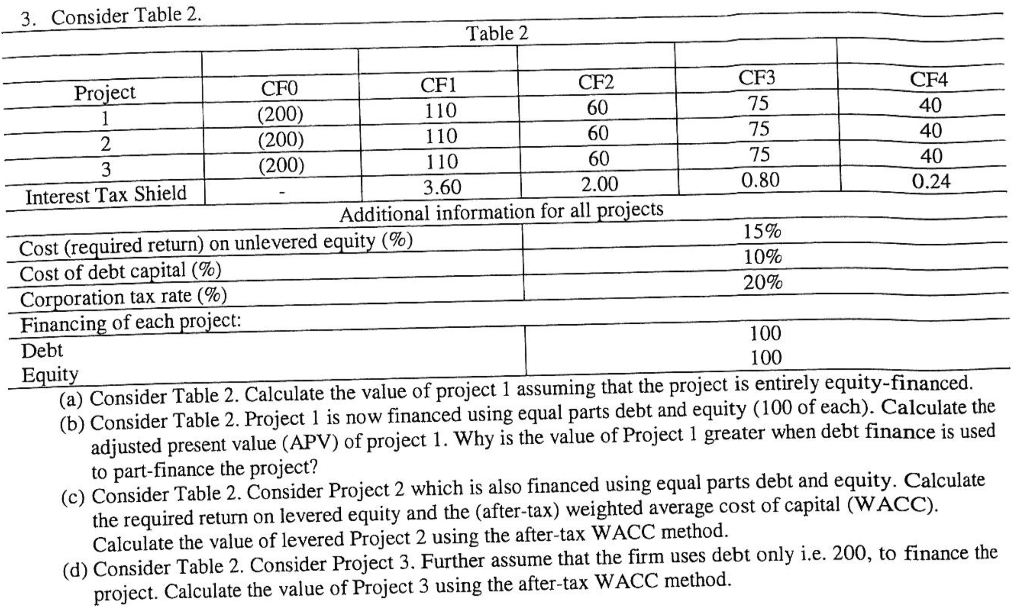

Question: Consider Table 2, 3. Table 2 CF3 CF4 CF2 CF1 110 CFO Project 75 40 60 (200) 75 40 60 110 (200) (200) 2 75

Consider Table 2, 3. Table 2 CF3 CF4 CF2 CF1 110 CFO Project 75 40 60 (200) 75 40 60 110 (200) (200) 2 75 40 60 110 0.80 0.24 2.00 3.60 Interest Tax Shield Additional information for all projects 15% Cost (required return) on unlevered equity (%) Cost of debt capital (%) Corporation tax rate (%) Financing of each project 10% 20% 100 Debt 100 Equit (a) Consider Table 2. Calculate the value of project 1 assuming that the project (b) Consider Table 2. Project 1 is no adjusted present value (APV) of project 1. Why is the value of Project 1 greater when debt finance is used to part-finance the project (c) Consider Table 2. the required return on levered equity and the (after-tax) weighted average cost of capital (WACC) Calculate the value of levered Project 2 using the after-tax WACC (d) Consider Table 2. Consider Project 3. Further assume that the fir project. Calculate the value of Project 3 using the after-tax WACC method is entirely equity-financed w financed using equal parts debt and equity (100 of each). Calculate the equal parts debt and equity. Calculate Consider Project 2 which is also financed using method. uses debt only i.e. 200, to finance the Consider Table 2, 3. Table 2 CF3 CF4 CF2 CF1 110 CFO Project 75 40 60 (200) 75 40 60 110 (200) (200) 2 75 40 60 110 0.80 0.24 2.00 3.60 Interest Tax Shield Additional information for all projects 15% Cost (required return) on unlevered equity (%) Cost of debt capital (%) Corporation tax rate (%) Financing of each project 10% 20% 100 Debt 100 Equit (a) Consider Table 2. Calculate the value of project 1 assuming that the project (b) Consider Table 2. Project 1 is no adjusted present value (APV) of project 1. Why is the value of Project 1 greater when debt finance is used to part-finance the project (c) Consider Table 2. the required return on levered equity and the (after-tax) weighted average cost of capital (WACC) Calculate the value of levered Project 2 using the after-tax WACC (d) Consider Table 2. Consider Project 3. Further assume that the fir project. Calculate the value of Project 3 using the after-tax WACC method is entirely equity-financed w financed using equal parts debt and equity (100 of each). Calculate the equal parts debt and equity. Calculate Consider Project 2 which is also financed using method. uses debt only i.e. 200, to finance the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts