Question: Consider the adverse-selection model discussed in class, where banks are trying to hire investment analysts. The market for analysts is competitive. A bank's profit

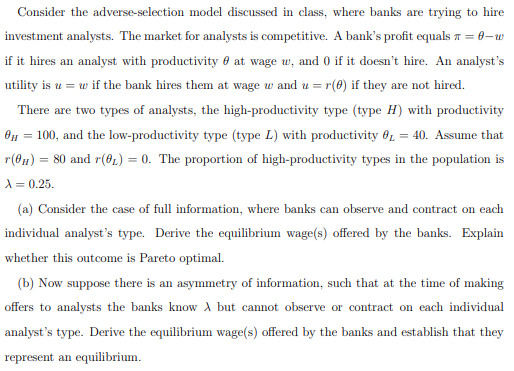

Consider the adverse-selection model discussed in class, where banks are trying to hire investment analysts. The market for analysts is competitive. A bank's profit equals = 6-w if it hires an analyst with productivity at wage w, and 0 if it doesn't hire. An analyst's utility is uw if the bank hires them at wage w and ur(e) if they are not hired. There are two types of analysts, the high-productivity type (type H) with productivity 0 = 100, and the low-productivity type (type L) with productivity L = 40. Assume that r(OH) = 80 and r(0) = 0. The proportion of high-productivity types in the population is A = 0.25. (a) Consider the case of full information, where banks can observe and contract on each individual analyst's type. Derive the equilibrium wage(s) offered by the banks. Explain whether this outcome is Pareto optimal. (b) Now suppose there is an asymmetry of information, such that at the time of making offers to analysts the banks know A but cannot observe or contract on each individual analyst's type. Derive the equilibrium wage(s) offered by the banks and establish that they represent an equilibrium.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts