Question: Consider the binomial model for stock prices.... 6. (Optional) Consider the binomial model for stock prices. Let {Xn, n = 1,2, ...} be a sequence

Consider the binomial model for stock prices....

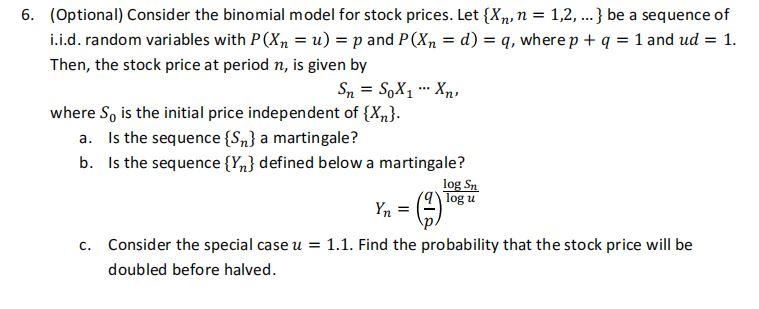

6. (Optional) Consider the binomial model for stock prices. Let {Xn, n = 1,2, ...} be a sequence of i.i.d. random variables with P(Xn = u) = p and P(Xn = d) = 9, where p + q = 1 and ud 1. Then, the stock price at period n, is given by Sn = S, X1 ** Xn, where So is the initial price independent of {Xn}. a. Is the sequence {Sn} a martingale? b. Is the sequence {Yn} defined below a martingale? log Sn log u C. Consider the special case u = 1.1. Find the probability that the stock price will be doubled before halved. 6. (Optional) Consider the binomial model for stock prices. Let {Xn, n = 1,2, ...} be a sequence of i.i.d. random variables with P(Xn = u) = p and P(Xn = d) = 9, where p + q = 1 and ud 1. Then, the stock price at period n, is given by Sn = S, X1 ** Xn, where So is the initial price independent of {Xn}. a. Is the sequence {Sn} a martingale? b. Is the sequence {Yn} defined below a martingale? log Sn log u C. Consider the special case u = 1.1. Find the probability that the stock price will be doubled before halved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts