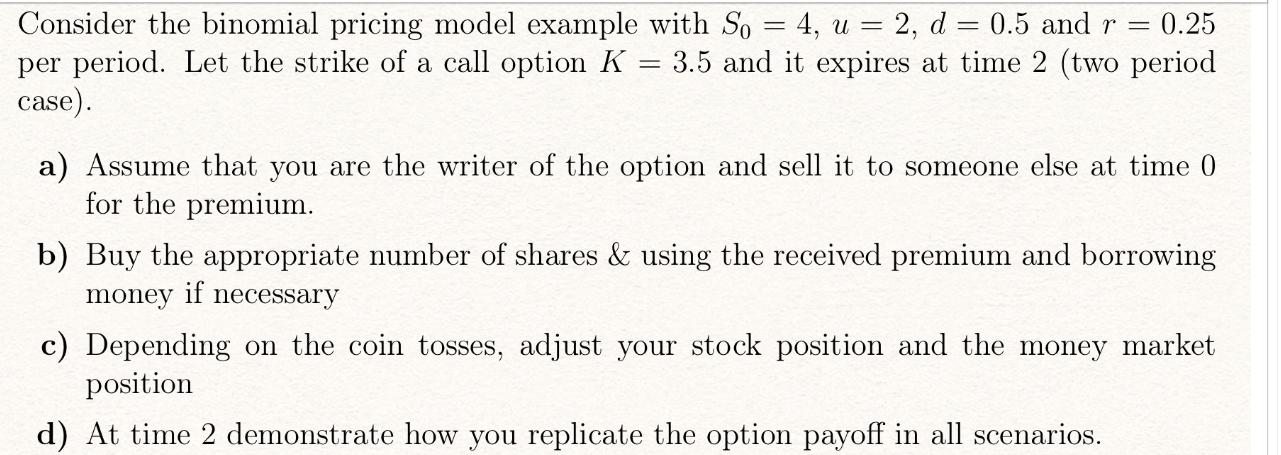

Question: == Consider the binomial pricing model example with So = 4, u = 2, d = 0.5 and r = = 0.25 per period.

== Consider the binomial pricing model example with So = 4, u = 2, d = 0.5 and r = = 0.25 per period. Let the strike of a call option K = 3.5 and it expires at time 2 (two period case). a) Assume that you are the writer of the option and sell it to someone else at time 0 for the premium. b) Buy the appropriate number of shares & using the received premium and borrowing money if necessary c) Depending on the coin tosses, adjust your stock position and the money market position d) At time 2 demonstrate how you replicate the option payoff in all scenarios.

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

a As the writer of the call option you receive the premium upfront in exchange for giving the buyer ... View full answer

Get step-by-step solutions from verified subject matter experts