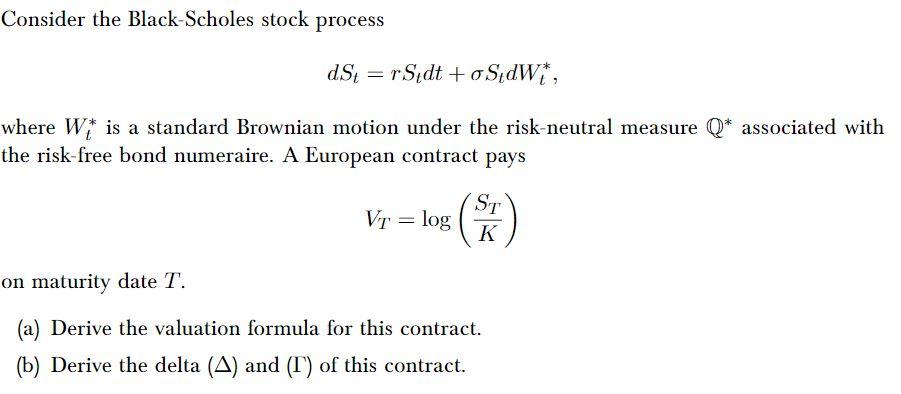

Question: Consider the Black-Scholes stock process dSt = r Sidt + o SidW*, where Wi* is a standard Brownian motion under the risk-neutral measure Q* associated

Consider the Black-Scholes stock process dSt = r Sidt + o SidW*, where Wi* is a standard Brownian motion under the risk-neutral measure Q* associated with the risk-free bond numeraire. A European contract pays Vr = log ( ST K on maturity date T. (a) Derive the valuation formula for this contract. (b) Derive the delta (A) and (I) of this contract. Consider the Black-Scholes stock process dSt = r Sidt + o SidW*, where Wi* is a standard Brownian motion under the risk-neutral measure Q* associated with the risk-free bond numeraire. A European contract pays Vr = log ( ST K on maturity date T. (a) Derive the valuation formula for this contract. (b) Derive the delta (A) and (I) of this contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts