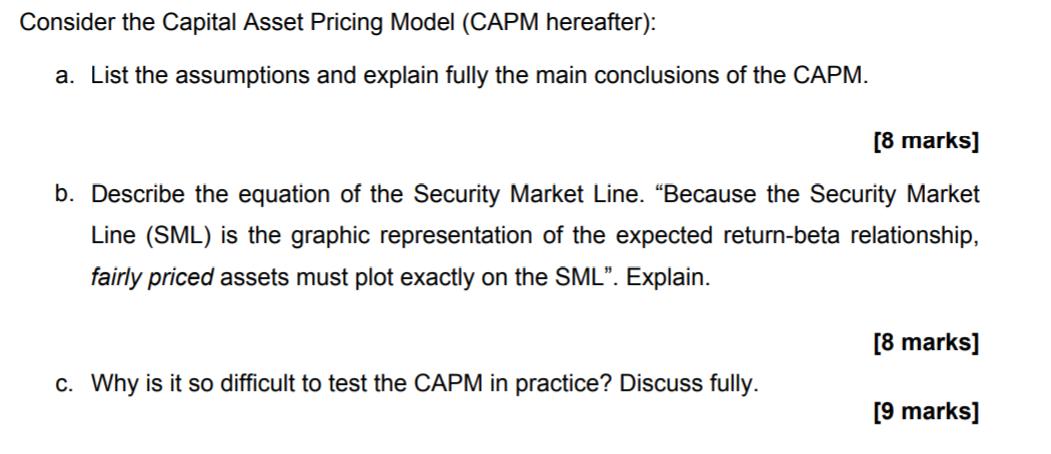

Question: Consider the Capital Asset Pricing Model (CAPM hereafter): a. List the assumptions and explain fully the main conclusions of the CAPM. [8 marks] b.

Consider the Capital Asset Pricing Model (CAPM hereafter): a. List the assumptions and explain fully the main conclusions of the CAPM. [8 marks] b. Describe the equation of the Security Market Line. Because the Security Market Line (SML) is the graphic representation of the expected return-beta relationship, fairly priced assets must plot exactly on the SML". Explain. [8 marks] c. Why is it so difficult to test the CAPM in practice? Discuss fully. [9 marks]

Step by Step Solution

There are 3 Steps involved in it

a The Capital Asset Pricing Model CAPM relies on several key assumptions 1 Perfectly Competitive Market Assumes that there are no transaction costs ta... View full answer

Get step-by-step solutions from verified subject matter experts